Hang On To Your Puts – More Downside To Come

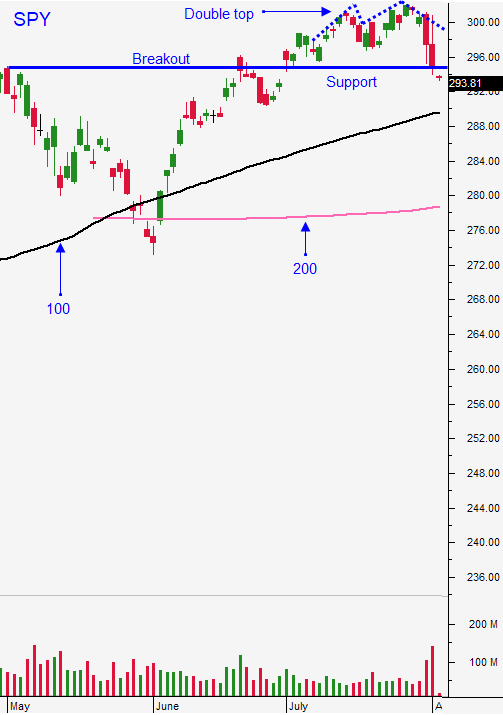

Posted 9:35 AM ET - Yesterday I looked like a fool in the morning and a genius in the afternoon. I've been expecting a market pullback and I've been pointing to the FOMC statement for weeks. The S&P 500 has broken minor support levels the last two days and this morning is below the breakout at SPY $295. I consider this a critical level and we should see additional selling the next few weeks.

In my comments I've pointed out that solid economic growth and record highs for the S&P 500 will keep the Fed sidelined. Wednesday we got the expected quarter-point rate cut and a bonus. The Fed stopped its balance sheet roll-off two months early, but that was not good enough for a market that is addicted to easy money. It wanted a clear signal that rates would be cut again in September. Powell's press conference will have a lingering effect the next few weeks since the Fed does not meet again until September.

At the beginning of the year I said that a trade deal with China was not likely before the 2020 election. Trump is the first president to stand up to China in decades and they don't want to do anything that will facilitate his reelection. I've pointed out the many ways that China has prolonged the negotiations. When trade talks were happening by teleconference it was a clear signal that the G20 meeting was a flop (not worth anyone's time to get in a plane). Trump's plan to increase tariffs by 10% on another $300 billion worth of Chinese goods in September sent shockwaves through the market. This morning we are seeing follow-through selling.

Earnings season has climaxed and all of the mega cap tech stocks have reported. These companies have been leading the market higher and optimism builds as they report. Once the news is out, profit-taking sets in. At a forward P/E of 17, stock valuations are elevated.

When Washington DC is in recess, investors get nervous.

Domestic economic releases have been solid, but there are signs of deceleration. ISM manufacturing (51.2) has been drifting lower for many months and it is just above contraction territory (50). Q2 GDP came in at 2.1% and that is down from 3.1% in Q1. The Unemployment Report this morning was in line with expectations (164,000).

From a longer-term perspective there is no reason to panic. Central banks are easing and interest rates are at historic lows. Bond yields do not keep pace with inflation so bond investors lose purchasing power. This forces investors to buy equities and we will see a strong market bid until there is a credit crisis (no current signs of strain).

Swing traders are short the SPY. Use a close above $299 as your stop. I did not catch the last leg of the market rally and I got the expected hate mail as a result. I have to stay true to my research and I've been saying for weeks that the upside rewards are smaller than the downside risks. I did catch the rally on a day trading basis, but I did not see the benefit of holding overnight positions. All of the gains from the last month were wiped out in two days and we are likely to see more downside. I believe the major moving averages will hold and they will present a nice buying opportunity later this summer.

Day traders need to be cautious on the open. I expect to see a bounce. Once the buying dries up, the downside will be tested. We won't see a decent rally until we hit a deep air pocket and reverse intraday off of that low. The following day we need to see follow-through buying. This pattern should surface around the 100/200-day MA. I plan to short intraday rallies once they stall. SPY $295 is a critical support level. If that fails we will see additional profit-taking and bullish speculators will be flushed out.

Today marks the end of a busy news cycle. Traders typically take time off before their kids go back to school and the next few weeks will be extremely slow. Trading volumes will dry up and intraday ranges will compress. A light news cycle favors the momentum.

Plan to take some time off.

.

.

Daily Bulletin Continues...