Take Profits On Some of Your Puts Today – Ride the Rest

Posted 9:30 ET - Yesterday the market found support and it staged a nice bounce. The selling from Monday was a little overdone and buyers nibbled. We are in a news vacuum and that favors the downward momentum.

China stabilized the yuan after being labeled a currency manipulator. Trade tensions are escalating and a deal will not be reached before the 2020 election. Trump realizes this and he will move forward with the next round of tariffs in September. He will shift his focus to Canada/Mexico (USMCA) and Japan.

Speaking of trade wars, South Korea and Japan have one of their own. Japan has stopped shipping high-tech components to South Korea. I believe this might make Japan a little more eager to sign a US trade deal.

Central banks continue to ease and New Zealand cut rates by a surprising 50 basis points overnight to 1.5%.

The Fed said that a rate cut did not signal the start of a trend. However, most Fed officials believe that two more rate cuts will happen this year and it sure feels like a trend. The market did not like that rhetoric since it is addicted to easy money and it wants its next "fix" in September. The FOMC statement was actually quite dovish. The market got the quarter-point rate cut it was looking for and a bonus (the balance sheet roll-off was terminated two months early). If the market continues to drop we will get the next quarter point cut in September.

Earnings season is winding down and great numbers were expected. At a forward P/E of 17 there was no room for error. All of the major tech companies sold off after reporting.

The economic calendar is light. ISM services fell to 53.7. That reading is still above contraction territory (50), but it was below expectations (55.4) and there is a steady trend lower.

England looks like it's headed for a hard exit in October and no negotiations are taking place with the EU.

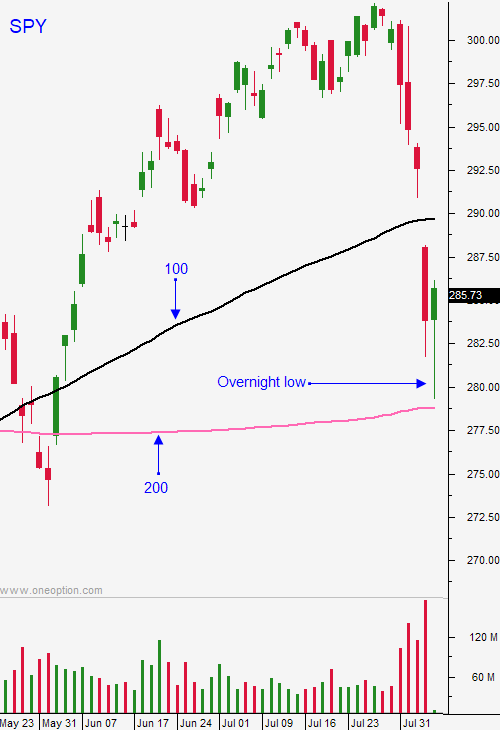

Swing traders are still short a half position. I know this might seem like blind luck, but a lot of thought goes into my stops. The SPY was $.15 from our $288.20 intraday price and we were not stopped out. We will exit half of the remaining position on the close today. Use an intraday stop of $288.20. I still believe that the market will test the 200-day moving average in the next few weeks, but I want to take profits. We are still in a long-term uptrend and we caught a nice move so it is prudent to take some chips off the table. I know that some of you bought puts. If you did, it is important to exit when the market is still falling because option implied volatilities are elevated. We will still have 25% of our original short position after the close today.

Day traders should look for shorting opportunities on the open. The S&P 500 was unchanged an hour ago and the bottom fell out when bond yields plunged. Momentum favors the downside.

Look for nervous trading the next few weeks.

.

.

Daily Bulletin Continues...