We Took Profits On All Shorts – Market Will Try To Fill the Gap

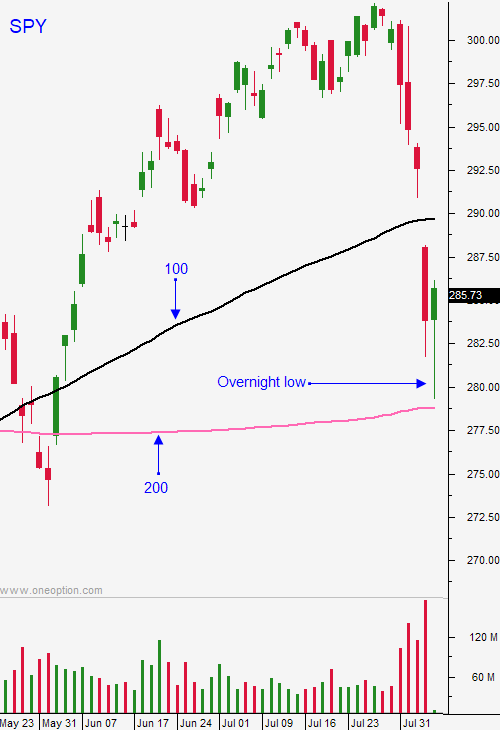

Posted 9:30 AM ET - The SPY has established a firm support level at $282. It has been tested twice and it is above the 200-day MA. Wednesday we saw a swift reversal from that level with follow through buying this morning. Horizontal resistance at SPY $288.20 has been breached this morning and the market will try to fill-in the gap. It will challenge the 100-day moving average today and we should spend time at that level over the next few weeks. Trading ranges will compress and the volume will decline during a news vacuum.

The landscape has not changed much overnight. All of the issues that sparked selling are still intact.

A trade war with China is likely. China's exports increased 3.3% and that was better than the 1.3% contraction a month ago. Imports declined 5.6% and that was also an improvement from the previous months 7.3% decline. This news gives China a little breathing room and it was a market friendly release.

The Fed has been extremely dovish and the negative reaction to Powell's FOMC press conference was overblown. The Fed cut rates and they ended the balance sheet roll-off 2 months early. India, Thailand and New Zealand all lowered interest rates yesterday and bond yields across the globe (including the US) plunged. On a short-term basis, investors loved the news. On a longer-term basis this is not a healthy sign.

Earnings season is winding down, Congress/Fed are in recess and the economic calendar is light. Trading volume will decline in the next two weeks as traders take time off.

Swing traders took profits on the short position when the SPY traded above $288.20. We also took profits Monday. This was a very quick and profitable trade. I believe the market will try to fill-in the gap the next two weeks. Option Stalker members will be trading stocks I highlighted in a video last night. We are buying post earnings stocks that gaped up after the announcement and that retraced to the breakout. These stocks are also strong relative to the market and they should perform well. I like selling out of the money bullish put spreads below the breakout and using that as a stop. Once the market gets to the 100-day MA we will compress.

Day traders should trade from the long side today. I believe the price action will be bullish. Watch for a drop off in volatility and activity. We are heading into the summer doldrums and the drop last week saved us from dull price action. If not for that bearish reaction to the FOMC and Trump's tariff hike we would have been watching the paint dry.

Trade this bounce until it stalls - then plan to take some time off.

I will not be posting market comments Friday.

.

.

Daily Bulletin Continues...