Market Will Compress Around This Level For A Few Weeks

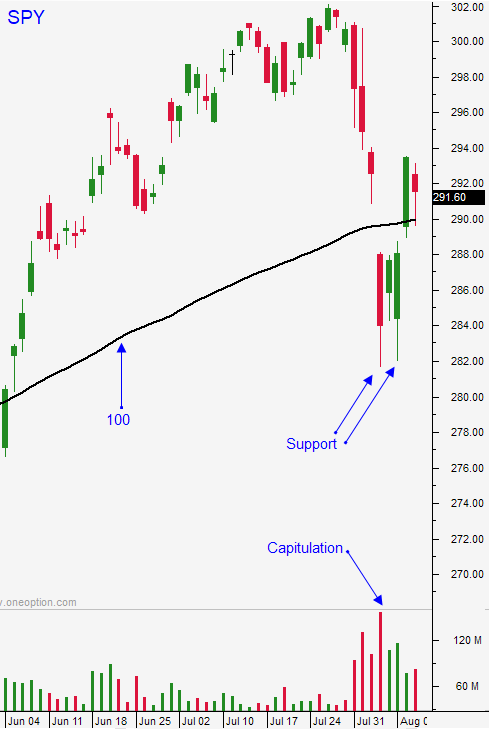

Posted 9:30 AM ET - Last week I mentioned that the market was likely to bounce and rest at the 100-day moving average. That's exactly what happened and the summer doldrums will set in. The news will be light for the next few weeks, trading volume will decline and the range will compress.

Nothing changed over the weekend. Trade talks with China have stalled and investors are worried that a tariff war will weigh on an already fragile global economy. There will not be a trade deal before the 2020 election.

I expect Trump to focus on low hanging fruit. He should be able to sign trade deals with Canada/Mexico (USMCA) and Japan if he shifts his focus. This would calm investor nerves and improve his chances for re-election.

Unrest in Hong Kong is escalating. Protests are attracting huge numbers and international flights have been canceled.

England is heading for a hard exit in October and their currency has been pounded, pardon the pun.

Central banks are easing. India, Thailand and New Zealand cut rates last week. The Fed is extremely dovish and a market drop before the September FOMC meeting might prompt them to take action. If the market treads water at this level they will not hit the panic button. Domestic economic activity is solid and they have breathing room.

Earnings season is winding down and retailers will report over the next few weeks. Stock valuations are fairly rich overall at a forward P/E of 17.

Swing traders are in cash. We took healthy profits on our shorts last week and we will reestablish positions if the market shoots higher from here. The upside reward is smaller than the downside risk. I'm expecting sideways price action the next few weeks and cash is king.

Day traders should wait for market support. The 100-day moving average held Friday and is likely to hold today. Look for buying opportunities off of that level. Make your money early and set passive targets. We've been fortunate to have some intraday volatility the last week and I'm expecting that to settle down.

Look for sideways price action and a trading range the next few weeks.

.

.

Daily Bulletin Continues...