Dovish “Fed Speak” Is A Sugar High – Get Ready To Short

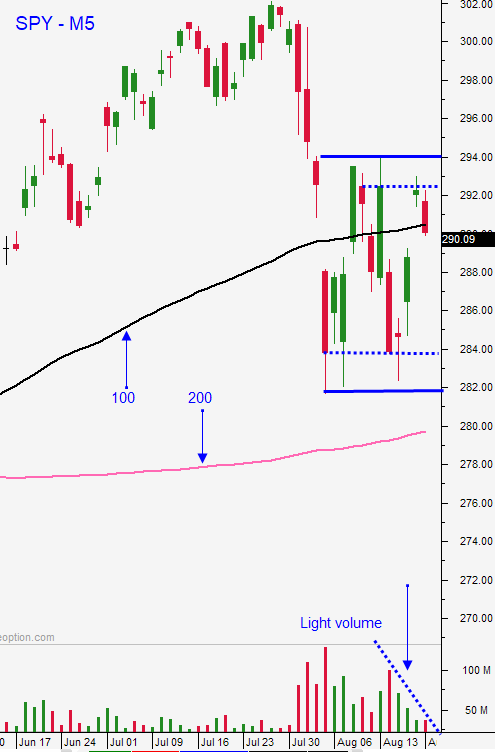

Posted 9:30 AM ET - The market is addicted to easy money and it wants another "fix". Yesterday's FOMC minutes did not spark much excitement and traders are hoping that "Fed speak" in Jackson Hole will point to a rate cut in September. Trading volume is very light and the SPY is pressing up against resistance at $294. That is the upper end of the range and I believe we are close to a shorting opportunity.

Trade negotiations with China are happening by phone. Officials are putting lipstick on this pig to calm investors. There will not be a trade deal before the 2020 election. China has threatened to retaliate against the $300 billion tariffs that were delayed until December. They are also threatening to blacklist any company that manufactures parts for the F-16V fighter jet being sold to Taiwan. The tone is antagonistic no matter what officials say.

The US should sign a deal with Japan and focus on low hanging fruit if it wants to calm investor concerns over global trade war.

In 2018 the US imported $684 billion worth of goods from the EU and $558 billion with the goods from China. US exports to Europe were $575 billion and only $180 billion to China. The good news is that we are not likely to pick a fight with Europe because we export a lot of goods to them. The bad news is that Europe's economy is fading quickly.

The manufacturing flash PMI for Europe was 47 (well into contraction territory) and the service PMI was 53.4 (a little better-than-expected). Germany's manufacturing PMI was 43.6 and their GDP fell .1% in Q2.

Germany issued the first-ever 0% 30-year bond and they sold less than half of what they wanted. Imagine giving someone your money for 30-years at 0%. I don't want to talk gloom and doom, but this is not a healthy sign long-term. Global yields are at historic lows.

Yesterday I mentioned that Boris Johnson lobed the Brexit ball into the EU's court and as expected an overhead smash is coming back over the net. Angela Merkel (Germany) said they have 30 days to solve the "backstop" disagreements. Emanuel Macron (France) said there will not be any further discussion on the divorce deal. He sees no reason to grant another Brexit delay. This train wreck is unfolding before our eyes and it will impact credit markets.

There are alarming macro developments that are taking place and they will have a long-term impact. Fortunately, I only trade what is in front of me. The market is only concerned with US economic growth and low interest rates.

Swing traders should remain in cash. The upside reward is very limited and I don't believe the market will have enough punch (even with dovish "Fed speak") to get through resistance at SPY $294. We will challenge that level this week. If we do get through it, I will be looking to short when we fall back below it.

Day traders should tread carefully on the open. The S&P 500 was in negative territory and there is some selling pressure. Opening gaps higher are typically faded. I will be watching for weakness and I believe the 100-day MA will be a magnet for the next few weeks. Trading ranges will compress around that level and the volume will be light.

Look for choppy trading on light volume. This is a low probability environment.

.

.

Daily Bulletin Continues...