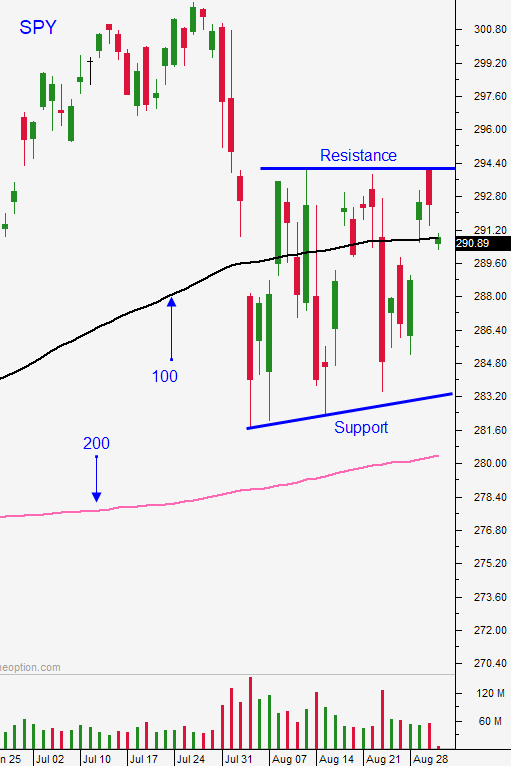

Market Will Test Resistance Today – Breakout Unlikely

Posted 9:30 AM ET - The S&P 500 is hugging the 100-day moving average. This morning it will challenge the upper end of the range at SPY $294 on positive overnight news. There are many cross-currents and sentiment can change quickly.

China's services PMI (52.1) was a little better-than-expected and the trade dispute with the US has softened slightly. Huawei suppliers have a little more time to sell product to the cell phone company (11/19). China will not impose the Hong Kong extradition bill and this could ease protests.

Retail sales in Europe were little better-than-expected (2.2%). Auto tariffs have been postponed until the middle of December.

The House of Commons is passing legislation to seek a three-month delay if a Brexit deal is not reached by the 10/31 deadline. This would temporarily postpone a hard exit.

A trade deal with Japan could be signed in the next few weeks. This would calm investors who are worried about a trade war with China.

The Fed is expected to cut rates a quarter of a point on September 18th. This will keep short-sellers at bay for the next two weeks.

ISM manufacturing slipped into contraction territory yesterday (49.1). Global weakness is spreading to the US, but investors will hold equities as long as the Fed is easing. ISM services and ADP will be posted tomorrow.

On the surface everything looks rosy this morning. Know that conditions are fluid and that sentiment changes instantly. New Chinese tariffs will be imposed in October, the protests in Hong Kong are likely to continue, a Scottish judge ruled that Boris Johnson can lawfully suspend Parliament until 10/31, US economic releases could be soft and the Fed might suggest that no more rate cuts are needed after the September move. Any of these issues can instantly spark profit-taking near the upper end of the trading range.

Swing traders should remain in cash. September is historically one of the worst performing months and we should expect volatility. A drop to the 200-day moving average would present a buying opportunity.

Day traders should be patient on the open. Gaps higher have typically been faded and resistance is heavy at this level. If the low of the day is breached in the first half hour of trading I will favor the short side. If the bid remains strong and we grind up to SPY $294 I will consider buying a breakout, but we need to make a new high for the day after two hours of trading. I will be a reluctant buyer (passive).

The 100-day moving average is a magnet and the most likely scenario today is a push higher followed by a gradual drift lower. Trading volume has been light and choppy trading should continue for another day or two.

.

.

Daily Bulletin Continues...