Here’s What I Expect the Market To Do Next Week

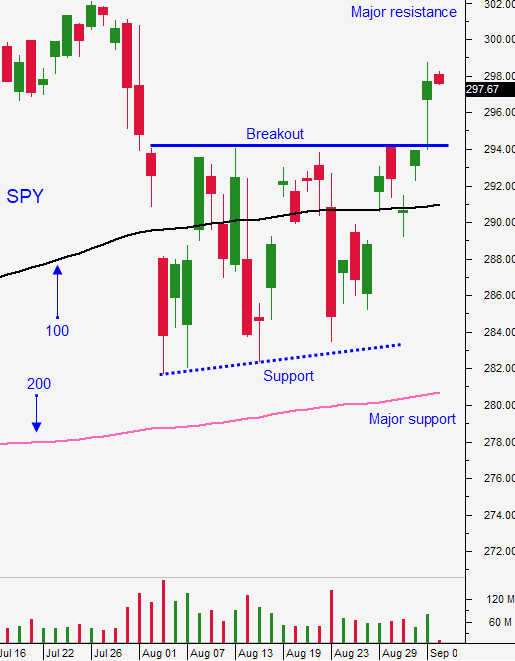

Posted 9:30 AM ET - Yesterday the market surged higher on positive news and it was able to breakthrough horizontal resistance. After 45 minutes of trading profit-taking surfaced and the momentum stalled. The SPY will challenge the $300 level this morning and resistance should hold.

China and the US will resume trade talks in October. That is a month later than expected and it demonstrates tension between the two nations. Both countries are trying to pacify investors with the promise of a deal knowing that an agreement won't happen before the 2020 election. Minor concessions from China and the US don't mean much. This news did spark buying, but I don't give it much weight. Ultimately, a trade deal between the two nations might not matter. US consumers are not feeling the pinch because China's currency is falling and because both economies are still growing. A trade deal might slow economic deceleration, but it won't stop the trend. Global weakness will eventually spread to the US and China.

A hard exit for England has been postponed until January 31st. That was big news and that dark cloud will not loom over the market the rest of the year.

ADP showed that 195,000 new jobs were created in the private sector during the month of August. That was a particularly strong number and I trust it more than the jobs report which showed that 130,000 new jobs were created in August. Holidays impact the government's number. ADP actually processes payrolls for small and medium-size companies so they have their finger on the pulse. ISM services came in at a very healthy 56.4. More than 80% of our economy is service based and this number is much more important than ISM manufacturing.

I am not in the "bad news is good news" camp where analysts focus more on rate cuts than economic growth. I believe that strong growth in the US and an upward sloping yield curve are good for the market. US growth is still intact and we are likely to get a quarter-point rate cut in 10 days. This is the best of both worlds and I believe this combination will keep profit-taking to a minimum next week.

Fed Chairman Powell will speak at 12:30 PM Eastern time today. Fed officials have been very vocal the last few weeks and I'm not expecting anything new.

Global yields are near historic lows and as long as credit concerns remain minimal the market bid will remain strong. Investors are pushed out on the risk curve. They have to own equities because bond yields don't keep pace with inflation and they lose purchasing power (negative real returns).

Unfortunately, we were not able to buy the SPY at our price yesterday. The market shot higher and it hit our target. I knew this would be a relatively short-term trade, but I thought I we should try to scoop any pullback so I gave it a shot. I believe that the market will be stable for the next two weeks. Nimble swing traders can take positions in stocks with relative strength. Use SPY $294 as your stop on a closing basis. Longer-term swing traders should watch from the sidelines. The downside and upside are limited at this level and we are likely to trade in a fairly narrow range the next two weeks.

Day traders should watch for an opportunity to short early in the day. Gaps higher have typically been faded and we saw resistance at the high of the day yesterday (where we will open today). A quarter-point rate cut is already priced into the market and the soft jobs report won't matter. Once support is established the market is likely to rebound and trade within the first hour range. Look for quiet trading and low-volume.

.

.

Daily Bulletin Continues...