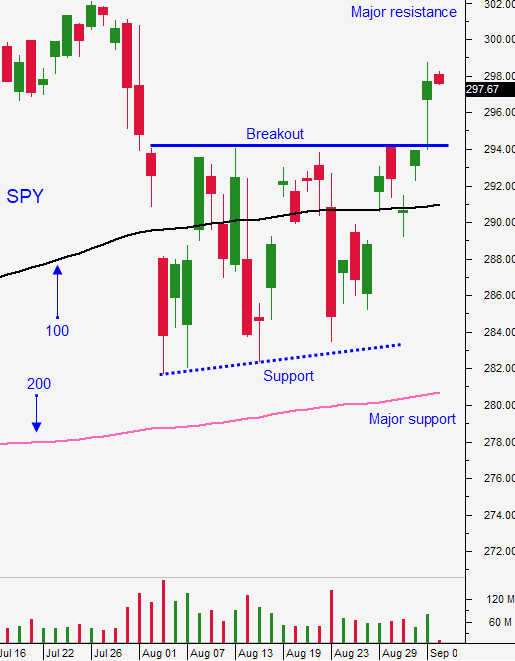

Market Is Going To Test the All-time High – Resistance Is Stiff

Posted 9:30 AM ET - Last week the market broke through horizontal resistance and we are seeing follow-through this morning. The news was fairly light over the weekend and the bid is fairly strong. US/China trade tensions seem to be easing and Brexit has been postponed until January 31st. Credit concerns are minimal and buyers will remain engaged. I'm expecting lackluster trading and a range from SPY $294 - $302.

Rumor has it that China will increase agricultural purchases if the US eases supply restrictions on Huawei and if it cancels the tariff increases slated for October 1st. If true, this will probably be a prerequisite to face-to-face negotiations in October. Trade tensions between the two countries are high and both sides know that a trade deal will not be reached before the 2020 election. Until then, they will try to keep things cordial so that investors remain calm.

China's trade numbers were little soft over the weekend, but the improved in Germany, England and Taiwan.

US economic growth is intact. ADP showed that 195,000 new jobs were created in the private sector during the month of August. I trust this number more than I do the jobs report published by the government (130,000). ISM manufacturing was in contraction territory (49.1), but ISM services was much better than expected (56.4). Our economy is service based and it accounts for 80% of our activity. Consequently it is a much more important number. As long as US economic growth remains stable the market will tread water.

The Fed is likely to cut interest rates next week and that is keeping sellers at bay. Stable US economic growth and monetary easing will provide us with a one-two punch.

Swing traders should remain in cash. We tried to scoop the market last Thursday and we never got the dip. At this level resistance will be stiff. The all-time high and rich stock valuations (forward P/E of 17) will provide a headwind. Since there aren't any current credit issues buyers will support the market at SPY $284. Global bond yields are at historic lows and investors are forced into equities so they don't lose purchasing power (negative real returns for bond investors). We have to wait for a dip.

Day traders should watch the early action. Gaps higher have typically been faded and the news over the weekend was not substantial enough to push us through major resistance. I believe the market will retrace this morning, find support and trade within the range the rest of the day.

The calendar is pretty light this week and investors are expecting monetary easing from the ECB on Thursday. Favor the long side, but expect tight intraday ranges.

.

.

Daily Bulletin Continues...