Nothing Scary About This Quad Witch – Favor the Long Side

Posted 9:30 AM ET - All of the bullish and bearish influences I've been mentioning the last few weeks are still in place. The market is trading in a tight range while it waits for a driver. This week's FOMC statement and quadruple witching did not spark a breakout.

Tariffs on 400 Chinese goods have been delayed and that is a slight positive as the framework for an October face-to-face meeting is being hashed out in DC.

We needed a negative reaction to the FOMC statement to get things moving and it barely lasted an hour. I feel the press conference was relatively hawkish, but it didn't spook investors. The market is pricing in another rate cut before year-end and most Fed officials feel that they are done for 2019. This small disconnect could lead to profit-taking if something unexpected happens.

Earnings season will start in a couple of weeks and pre-announcement warnings could be one of those surprises (unlikely) . Boris Johnson is hell-bent to make sure England leaves the EU on Halloween. This seems very unlikely, but perhaps he has some tricks up his sleeve.

The overnight repo issue is temporary and the Fed is injecting liquidity.

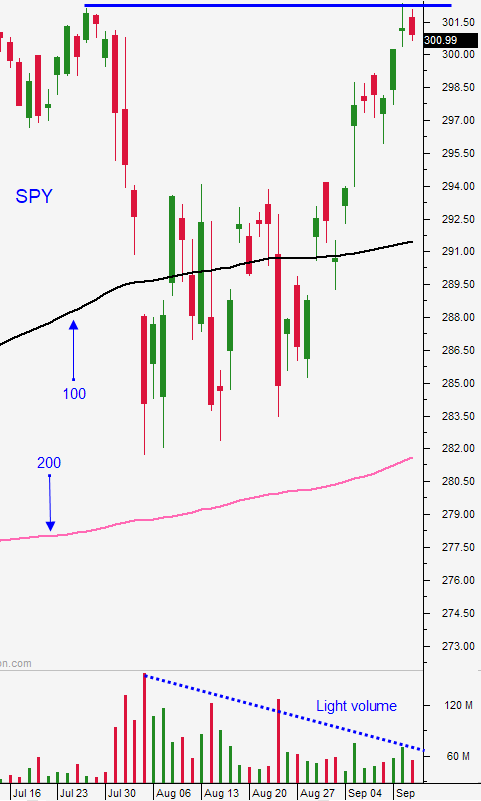

Swing traders should remain in cash. I don't see the upside catalyst until earnings begin. Until then we have to wait for a dip. Support is at SPY $299.45 and resistance is at SPY $302.50. Trading volume the last two days looks healthy, but it was tied to the FOMC statement and quadruple witching. Price has not changed so the volume is meaningless (just position squaring).

Day traders should focus on the long side. The bid is strong and the market wants to test resistance at the all-time high. Focus on stocks that have relative strength and set passive targets. The market has a tendency to establish an intraday range and migrate back to the opening price (doji). We are likely to stay within yesterday's trading range (inside day). Reduce your size and your trade count.

Global yields are plunging and the Fed is ready to cut rates if needed. This safety net will keep a bid to the market. Fixed income investments don't keep pace with inflation so Asset Managers will favor equities as long as credit conditions remain stable. Trump will “play nice in the sandbox” ahead of the election so inflammatory tweets should be minimal. Look for very lackluster trading today.

.

.

Daily Bulletin Continues...