Excellent Swing Trades Will Set-up If This Happens

Posted 9:30 AM ET - Last week the Fed cut interest rates by a quarter-point. That move was largely expected and traders were watching for future signs of easing. We learned that most Fed officials feel that they are done for the year. The market is pricing in another rate cut this year and I believe the selling Friday was a delayed reaction. Quadruple witching may have played a small role in the drop Friday. Once the momentum was established it fueled the move.

The overnight news was very light and it has a negative bias. Flash PMI's in Europe were weaker than expected with the composite coming in at 50.2. That is barely in expansion territory for all of Europe. Germany (fourth-largest economy in the world) was atrocious. Their manufacturing PMI tumbled to 41.4 in September. I have little doubt that they will have a second consecutive quarter of negative growth, officially putting them into a recession.

China's trade deputy returned home with upbeat comments. The next face-to-face negotiations are scheduled for the second week of October. This will keep buyers engaged and the market bid should remain relatively strong until then.

Boris Johnson is undeterred and he still plans a hard exit for England on Halloween. He is swimming upstream and he must have some tricks up his sleeve.

Earnings season is just around the corner and we have to be mindful of pre-announcement warnings. I haven't seen many, but they would throw a wrench into this rally if they ramp up. Stocks are trading at the upper end of their valuation range and they are vulnerable.

The news will be very light this week.

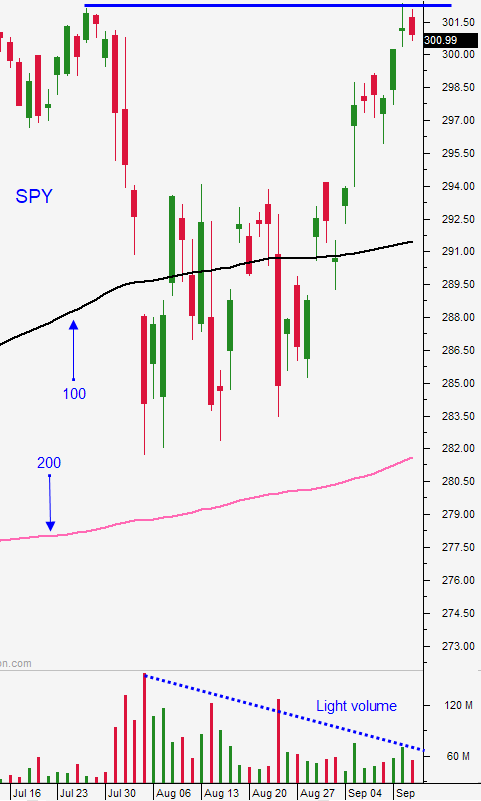

Swing traders should remain in cash. Asset Managers are not going to chase stocks at the all-time high when they're trading at a forward P/E of 17. Global economic conditions are softening and the Fed might be done easing this year.

Day traders should favor the short side. The market tried to break through the all-time high three times in the last week and resistance is building. Stocks closed on their low Friday and the bid will be tested early. Support is at SPY $296 and $294. Resistance is at $302.50. Trading volume remains light. Don't be fooled by the increase Thursday and Friday. That was due to the FOMC statement and quadruple witching. Neither event sparked much of the move. I'm expecting a quiet day today and we should stay within Friday's range (inside day).

Favor the short side if you're day trading and cheer for weakness if you are a swing trader. We need that market dip before we can trade from the long side.

.

.

Daily Bulletin Continues...