These 2 News Releases Will Keep Buyers Engaged Today

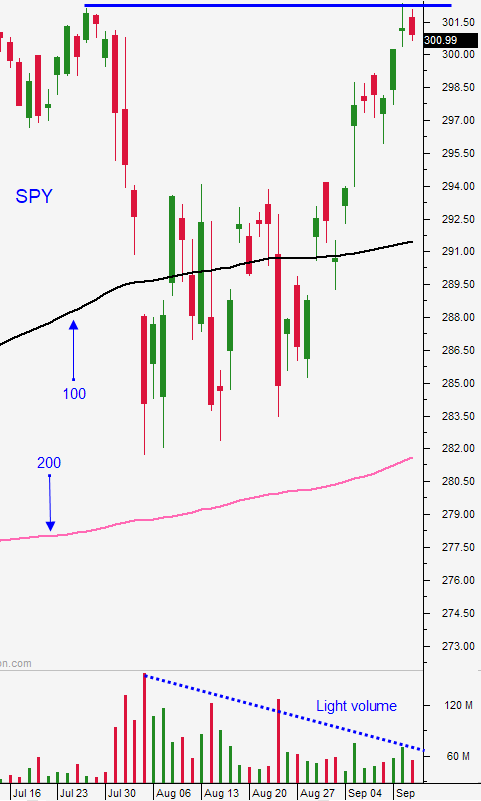

Posted 9:30 AM ET - During the last month and a half of trading with only had a few days where the volume is above average. Last week we saw a small spike due to the FOMC statement and quadruple witching. Those events did not spark movement and there is a very low level of conviction. Traders are constantly looking for the next "driver" and it never materializes. The market will be trapped in this trading range until earnings season begins.

The news is very light. Face-to-face trade talks with China have officially been confirmed for October and that is a slight positive for the market. Boris Johnson unlawfully suspended Parliament according to the Supreme Court. It does not appear that he will be able to force a hard exit for England on Halloween and that is bullish for the market.

Deteriorating global economic conditions will keep resistance firmly in place at the all-time high. Fed officials don't see the need for another rate cut this year, but the market is pricing one in. Stock valuations are at the upper end of their range and Asset Managers are not worried that they will miss a year-end rally. The headwinds are fairly stiff at the all-time high.

Buyers will scoop stocks on pullbacks to technical support. Global bond yields are at historic lows and fixed income investments don't keep pace with inflation. Corporations are issuing debt at extremely attractive rates and they are using the proceeds to buy back shares. These forces will keep the market afloat as long as there aren't any credit concerns.

In short, we are trapped in a trading range that could last a while.

Swing traders need to wait for a dip. We need to enter at better levels and to see some volume. A pullback will provide us with a bounce and the rebound should produce a series of bullish days that we can ride. Until then, the market is just chopping back and forth.

Day traders should focus on the long side. Wait for support to be tested and find stocks with relative strength. In the daily trading videos I've been posting just after the open I've been able to find stocks with good momentum and follow through. Volume spikes are an important criteria to use in your searches. Set passive targets and reduce your size/activity until the volume returns. Support is at SPY $296 and $294. Resistance is at $301 and $302.50.

.

.

Daily Bulletin Continues...