Time To Buy Stocks and Sell Put Spreads – We Got the Pattern!

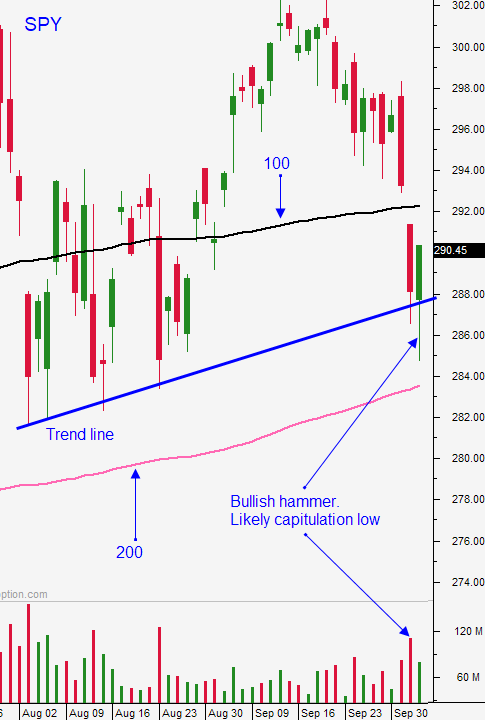

Posted 9:30 AM ET - Yesterday the market sold off after the ISM services number was released. Economic weakness abroad is starting to impact domestic activity and investors are nervous. The initial reaction was negative and the S&P 500 almost touched the 200-day moving average. We were trying to buy just above it and we just missed our entry point. Buyers scooped shares and we got the intraday reversal we were looking for.

In yesterday's comments I mentioned that we needed to see a deep drop and two long green candles stacked one on top of the other. That pattern came just after the low of the day and the buying momentum was strong into the close. On a daily chart you will see a bullish hammer. Notice the green body and the long tail under the candlestick. This is a bullish formation and it's time to buy.

ISM services came in at 52.6 and that was much lower than expected (56.0). The service sector accounts for 80% of our economic activity and it is a very important number. It is still in expansion territory, but that was a dramatic decline. ADP was also a little soft (135,000) and this morning the jobs report showed that 136,000 new jobs were created in September. The market is addicted to easy money and this week’s numbers make it more likely that the Fed will cut rates once more this year.

Global central bank easing is pushing interest rates down. Yields are not keeping pace with inflation and fixed income investments lose purchasing power. This condition forces investors to buy stocks and it creates a safety net for the market.

Face-to-face trade negotiations with China will resume next week. The tone should remain friendly, but don't expect any progress.

Japan could sign a trade deal with the US and this would be a market friendly event.

I am not overly concerned with Brexit or impeachment hearings.

Swing traders should buy a full position of the SPY this morning. There has not been a decent swing trading opportunity in a long time and we will buy at this level. When I suggested buying at $284 yesterday I thought the market might bounce above the 200-day moving average ($283.40) but I needed to go just a touch higher. We just missed an excellent entry point. I still feel that the market will rally next week and we will set a target of $297 and a closing stop of $283. Earnings season typically attracts buyers and "Fed speak" should be market friendly. I like selling out of the money bullish put spreads and I have been highlighting them in my daily videos. Make sure the short strike price is below technical support and buy the spread back if that support is breached.

Day traders should look for an opportunity to get long early. Tech stocks have been beaten down and I'm seeing some good opportunities as they rebound above major moving averages. We got the capitulation pattern we were looking for yesterday and we should see follow-through the next few days.

Get long and take some overnights - it’s been a long time since I’ve been able to say that.

.

.

Daily Bulletin Continues...