Two News Events After the Open Will Impact Trading – Watch For Them

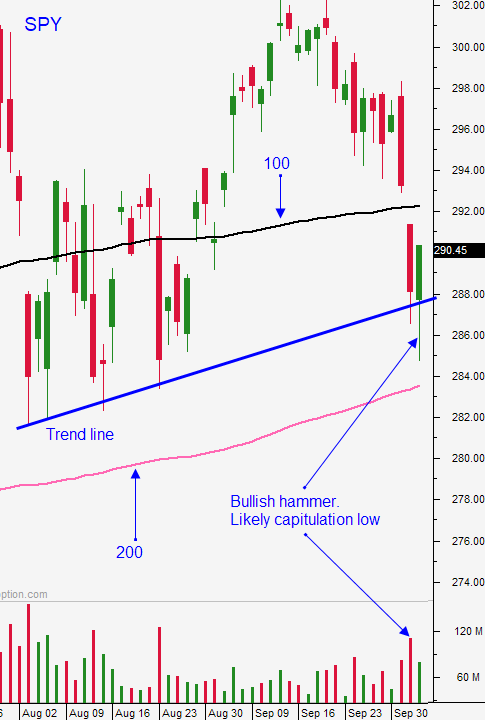

Posted 9:30 AM ET - Yesterday the S&P 500 dropped below the 100-day moving average and it closed on its low of the day. This choppy price action reminds me of August when we had big gaps higher and lower around the 100-day moving average. This is a tough swing trading environment and there are many cross-currents. The bid is strong at major technical support levels and resistance is stiff near the all-time high.

Face-to-face trade negotiations with China will resume tomorrow. Unlike most of the other meetings, the expectations are low. The US has blacklisted Chinese companies for civil rights violations and it has restricted travel for Chinese citizens for the same reason. China has retaliated by restricting travel to Americans who have expressed anti-China opinions. A trade deal with China will not happen before the 2020 election. Both sides are meeting to calm investor concerns. The best we can hope for is a delay in future tariffs.

Boris Johnson feels that a hard exit for England is very likely. His last-ditch proposal to the EU was rejected. Parliament passed a law that would require England to have an exit deal. Right now it is uncertain how all of this will play out. We may have more clarity on October 31st. A hard exit would have a negative impact on the market.

The Fed Chairman will speak again this morning. Traders will be looking for any hint of a rate cut in three weeks. Last week's economic data was soft (ISM manufacturing, ADP, ISM services and the Unemployment Report) and the Fed has indicated that they are ready to ease if economic conditions deteriorate. This afternoon the FOMC minutes will be released and they are likely to have a market impact.

Earnings season will start next week and the expectations are high. Stocks are trading at a forward PE of 17. Pre-earnings warnings have been minimal. Major banks dominate the early releases and lower interest rates could negatively impact future profits. Job growth has been steady this quarter so current profits should be healthy.

Swing traders need to stay sidelined during this chop. We were able to scratch our SPY trade on the open yesterday. I still like selling out of the money bullish put spreads on stocks with relative strength and major technical support below the current level. That was my focus in last week's swing video and those stocks have performed well this week. I will find more of these candidates in the weekly video tonight.

Day traders should tread cautiously early in the day. Powell's opening remarks in Denver will have an impact. I am not expecting a clear indication of policy in three weeks and the market could be disappointed. If we start to fill-in the early gap higher the momentum will build and a shorting opportunity will present itself. If the rhetoric clearly points to a rate cut the market will challenge the 100-day moving average. We also have to be careful at 2:00 PM Eastern time when the FOMC minutes are released. The market is very news driven and it's almost impossible to predict the reaction. The low from yesterday is support and resistance is at the 100-day moving average. Since we are below SPY $292.58 I am favoring the short side. Tread cautiously and watch out for these landmines today.

I will have more clarity when I post my morning video an hour after the open.

.

.

Daily Bulletin Continues...