Nothing Spooky About This Market – Use This Option Strategy

Posted 9:30 AM ET - Yesterday the market rallied to a new all-time high. As expected the Fed cut interest rates by a quarter-point and the press conference was a little more hawkish than the market wanted. Apple and Facebook posted solid results and the stocks are up after the announcements overnight. This morning we are seeing a little profit-taking and the S&P 500 is down seven points. The outcome will from this round of news did not produce the pullback we wanted. We can expect light volume and lackluster trading.

Many analysts were expecting a let-down after the FOMC statement. When everyone shares the same forecast the expected outcome is less likely to happen. Fed officials are happy with current policy and they feel that some of the risks have been reduced (Brexit and US/China trade relations). Domestic economic conditions are stable and the Fed’s language suggests a pause.

ADP came in better than expected and advanced Q3 GDP was also better-than-expected. Official PMI's were a touch better-than-expected in Europe (although still at very low levels) and slightly worse than expected in China. The economic calendar has been heavy this week, but the numbers have been in line. Tomorrow's jobs report should be a non-event.

China said that a comprehensive trade agreement with the US is unlikely. We already know that and the best we can hope for is a truce. The market seems content with that, it just doesn't want tensions to escalate.

Apple and Facebook posted solid numbers and they are the last of the mega cap tech stocks to report. Apple has been in a strong uptrend and it looks vulnerable to profit-taking. Facebook might have room to run. Sellers are passive ahead of mega-cap tech stock earnings releases and they are likely to get more aggressive in the back half of earnings season now that they have reported. Stock valuations are at the upper end of the range and results have been better than feared.

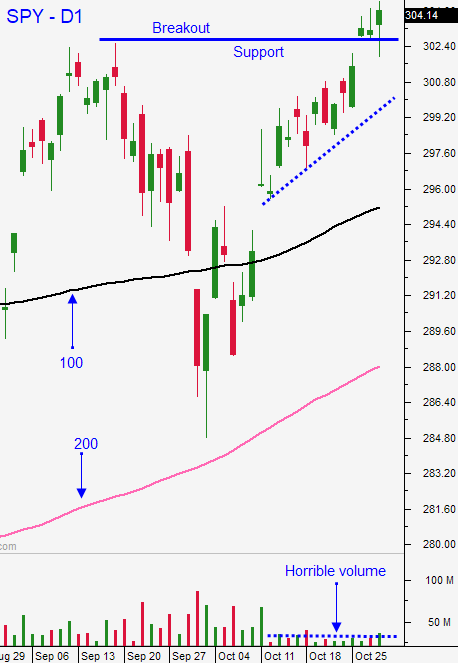

Trading volume is usually brisk this time of year and it has been anemic. I don't trust this light volume rally and I feel that bullish speculators will get flushed out at some point. It might only be a one or two day drop and that could come from higher levels when the breakout is tested.

Swing traders should add new bullish put spreads this morning. Scale into positions. We want to see the breakout hold for a few days so don’t go overboard today. If SPY $302 holds we will add to positions. I'm expecting light volume and a gradual drift higher. These gains can easily be stripped away in one day. Focus on stocks with strong technical support and your short strike price should be below that level. If it is breached, buy back the spread. Look for post earnings plays where the stock gapped higher on the news. Option Stalker searches of the stocks and there are many to pick from. If the market falters stocks with relative strength will weather the storm. Bullish put spreads allow us to take advantage of time decay and we can distance ourselves from the action. We can't get aggressive with longs until we have a pullback.

Day traders should focus on the long side. I believe the early dip this morning will be a buying opportunity. Apple and Facebook posted good numbers so tech should have a decent bid today. Support is at SPY $302 and resistance is at the all-time high.

I was hoping for a market pullback and so was everyone else. Unfortunately, dull trading with tight ranges and a slight upward bias are likely the next few weeks. Sell bullish put spreads.

.

.

Daily Bulletin Continues...