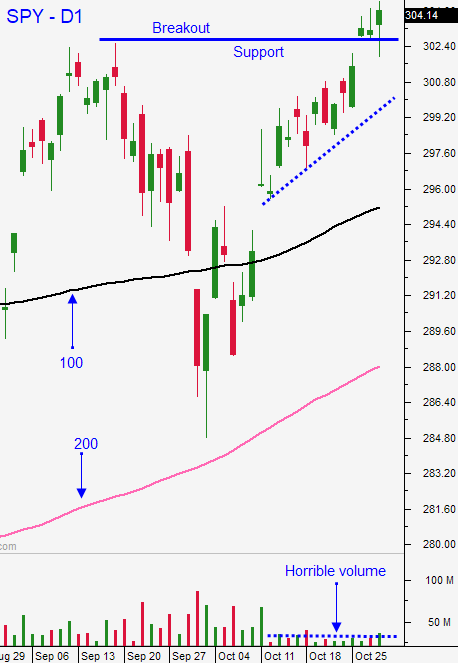

Market Breakout Confirmed – Sell Bullish Put Spreads – No Speedbumps

Posted 9:30 AM ET - This week the market broke out to a new all-time high. It has tested the breakout twice and both times stocks bounced off of that support. The long tails under the bodies are a sign that the bid is strong and stocks are poised to grind higher.

US/China trade negotiations should result in a truce this month and that removes uncertainty.

Brexit has been postponed until January 31st and an agreement is very possible given the vote last week.

The Fed cut interest rates by a quarter-point Wednesday and they are very satisfied with the current level. They cited stable economic conditions and improving political risks (US/China trade negotiations and Brexit).

Official PMI's were in line with expectations this week. This morning China's Caixin manufacturing PMI came in much better than expected and it hit the highest level in two years (51.7).

The unemployment report showed that showed that 128,000 new jobs were created during the month of October. That was much better than the 89,000 that was projected and the number was negatively impacted by UAW strikes. ISM manufacturing will be posted 30 minutes after the open. A weak number is expected and surprise favors the upside.

Earnings were good this week and AAPL and FB rallied after the number.

Swing traders can buy a half position of SPY. We tested the breakout twice this week and buyers stepped in. Stocks were down most of the day yesterday and late day buying erased most of the losses. On the daily chart you can see the long tails underbody. The volume during these two negative days was strong and the late day reversals on strong volume are bullish. Sell out of the money bullish put spreads on strong stocks that have reported earnings. Make sure the short strike price is below technical support. Gradually scale into positions. The Option Stalker Strong After Earnings search is has great candidates. Get the best of the best by adding the D1 buy signal filter. I'm not expecting a huge rally, just a grind higher. The calendar is light the next two weeks and I don't see any speed bumps ahead. Use SPY $302 as your stop on a closing basis.

Day traders should make sure that the early gains hold. Once support has been established, buy stocks. I will be using the Heavy Buying search in Option Stalker this morning. The breakout has been tested and it held. Under-allocated Asset Managers will get a little more aggressive now that they know a dip is not coming. Beginning-of-the-month fund buying should fuel a rally the next two days.

Look for a gradual float higher on light volume.

.

.

Daily Bulletin Continues...