Don’t Chase the Market – Be Patient and Add Bullish Put Spreads On Dips

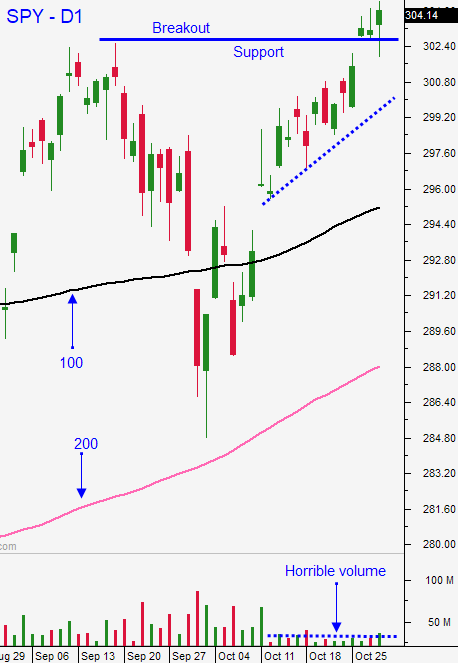

Posted 9:30 AM ET - Last week the market broke out to a new all-time high. It tested the breakout twice and both times buyers stepped in late in the day. Those long tails under the body of the candle confirmed the breakout. Swing traders bought a half position of the SPY on the open Friday. Stocks will open strong this morning.

The light volume we saw in October suggests a low level of conviction. Asset Managers are not going to aggressively chase stocks at the upper end of their valuation range (forward P/E of 17). The big volume the last three days were bullish and I liked the late day buying. We were all hoping for a dip after the FOMC statement, but we didn't get one. Under-allocated Asset Managers are playing catch-up.

The Fed cited stable economic conditions and reduced global risks (US/China trade dispute and Brexit). They are content with the current level of interest rates and they are not likely to lower rates again this year.

That is not the case with the new ECB president Christine Lagarde. She plans to print money like mad and she criticized Germany and the Netherlands for having a budget surplus. This might not have an immediate impact, but it does scare me long-term.

Earnings season has been better than feared and all of the mega cap tech stocks have reported.

The economic news last week was good. GDP was better than expected and the jobs report was also good considering the UAW strikes. ISM services will be posted tomorrow and it will be an important number.

The news cycle will be pretty slow the next two weeks and that favors momentum.

Swing traders have a half position around SPY $305 and we are going to use that as our stop on a closing basis. Set a target at $310. I don't know that we will get there today, but I want to have an order working. Sell bullish out of the money put spreads on strong stocks that have reported good results. I am using Option Stalker to find earnings gaps where the stock has been able to hold the gap and where it has good relative strength. My short strike price is below the opening price from the gap higher. We added positions Friday. The market is going to gap higher this morning and those moves have been vulnerable. I'm not going to add to bullish put spreads today until I see firm support. This rally feels fantastic, but it is one bad news item away from profit taking. Tread cautiously and know that the Fed is sidelined.

Day traders should wait for a dip. Don't chase stocks right out of the gate. Option Stalker searches will detect heavy volume, relative strength and a buy signal across multiple time frames. These are the stocks I want to day trade. Any market dip will help me identify the "real McCoy's". Monday's have typically been slow and I don't see any major news events to justify the rally. I believe fear of missing out (FOMO) might be fueling this pop. Favor the long side, but wait for support. If by chance the market surges higher out of the gate I will use the opening price as my gauge for a shorting opportunity. If that low of the day fails we could see a nice little reversal and I will short the futures. I'm not expecting a lot of selling and dips will be an opportunity to get long.

The news cycle is light and we should see bullish price action for the next two weeks. Focus on the long side and sell out of the money bullish put spreads on strong stocks while we have a pullback.

Support is at SPY $305 and $302.

.

.

Daily Bulletin Continues...