Watch For This Opportunity During the Day – It Could Provide A Nice Entry Point

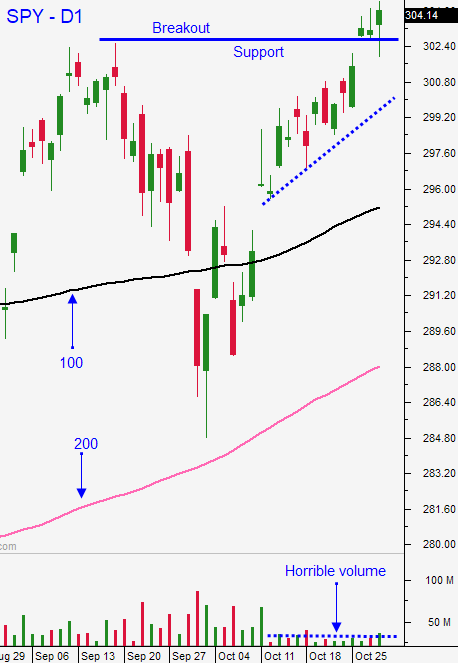

Posted 9:30 AM ET - A month ago we were testing the 200-day moving average and we have rallied 10% since then. The market broke out last week to a new all-time high and the follow-through has been good. Back-to-back reversals off of the breakout came on heavy volume and support has been confirmed. Asset Managers who wanted to buy an FOMC dip never got one and they are playing catch-up.

ISM services will be posted 30 minutes after the open and it could provide an opportunity. Economic data points from Europe have stabilized and they've been ticking higher in China. Domestic numbers have beaten expectations. ISM services was much weaker than expected a month ago and that reading has the potential to improve. If the number is soft the market is likely to pullback. That would provide an excellent entry point for long positions and I don't believe the selling will last. If the number is better than expected the market will rally and you should join the move for a nice day trade.

US/China trade talks continue and a truce is likely. Rumor has it that new tariffs in December must be delayed to keep China at the negotiating table. China will enforce intellectual property laws and they will purchase more ag products from the US. The US may allow domestic companies to sign licensing agreements with Huawei. In short, the negotiations seem favorable and the market likes the news. We know that conditions can change instantly.

China's services PMI came in at 51.1 as expected. The PBOC eased overnight. Chinese stocks have been strong.

A Brexit deal is possible and that is removing uncertainty.

The Fed cut interest rates last week and they are content with the current monetary policy. We should not expect another rate cut unless economic conditions deteriorate dramatically (unlikely).

Earnings season has been good, but stocks are trading at the upper end of their valuation range. This will provide a stiff headwind. Mega cap tech stocks have reported and sellers will be more aggressive. Profit-taking will surface on the first whiff of bad news.

Swing traders are long a half position of SPY at $305. We did not get more aggressive because of the light volume. If we had an FOMC dip we would've bought a full position. Set a target of $310 and a stop of $305 on a closing basis. You should have been entering bullish put spreads the last few days and those positions should be making money. Our positions are mildly bullish and I don't see any speed bumps for the next two weeks. Short-term swing traders with a holding period of three days or less should use the Option Stalker PopBull search. It looks for long-term compressions and horizontal breakouts through resistance on heavy volume. This pattern produces sustained rallies and I'm seeing a lot of cyclical stocks on the list. I don't trust these names on a longer-term basis, but they have strong momentum right now.

Day traders should look for bullish opportunities during the first half hour. Line up your candidates and have orders ready for the ISM services number. If the reaction is bullish buy your stocks. If it is bearish, wait for support and gauge relative strength. I like using the Heavy Buying search in Option Stalker. The Relative Strength30 search has also been excellent. Stocks seem a little "hot" and I will buy more aggressively on a pullback then I will on a surge higher. I don't like chasing at this level – be patient.

As long as the market makes nice gradual moves higher the dips will be shallow and brief. If the market melts up, we need to watch for profit-taking. Support is at SPY $305.

Look for a nice upward bias the next two weeks. We should expect opening gaps higher and compressed activity during the day.

.

.

Daily Bulletin Continues...