Watch For These SPY Patterns On the Open Today [They Will Determine Market Direction]

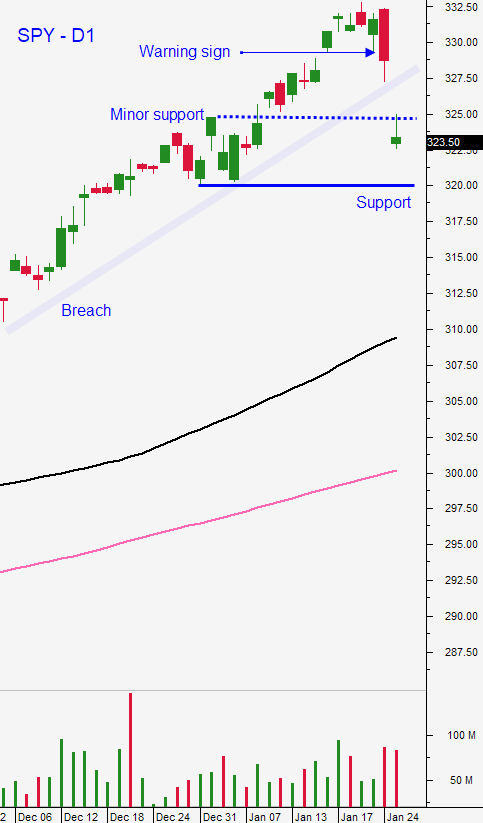

Posted 9:30 AM ET - PRE-OPEN MARKET COMMENTS TUESDAY - Yesterday the SPY fell through technical support at $325 and it closed near the low if the day. This morning, it is trying to rally back up to that $325 level and this bounce will tell us how anxious Asset Managers are to buy stocks. I believe that the market could rest today after a big move Monday when major news is pending. If the market tries to rally this week and it makes a lower high followed by a long red candle closing on its low on a daily chart, there will be another wave of selling.

After the initial drop yesterday, traders took a deep breath and the market compressed for most of the day. Earnings season will kick into high gear today when Apple reports (after the close). It will set the market direction for Wednesday. AMD will also have an impact on semi-conductors and we will see if it can keep pace with Intel's solid number. Boeing, Facebook, Microsoft and Tesla will announce Wednesday after the close and Amazon reports Thursday after the close. These companies account for a fifth of the S&P 500 and we will find out how much gas is left in the tank. At a forward P/E of 18 the headwinds will be blowing.

The Coronavirus is spreading quickly and the number of new cases doubled from 4000 to 8000 overnight. Scientists feel that the virus can be spread before carriers show symptoms, making it difficult to control the outbreak. This was very untimely given that China is celebrating lunar New Year and it will definitely impact China’s economic activity.

Durable goods orders declined .9%, but it is a volatile number - don't read too much into it. The official PMI's on Friday will be more important.

The FOMC statement will be released tomorrow and we can expect dovish comments from the Fed. They may reference the Coronavirus and they will stand ready to ease needed.

Swing traders should be ready to sell out of the money bullish put spreads on strong earnings reports. The reaction to earnings releases this week will reveal the strength of the market. I am particularly interested in stocks that drop after a gangbuster earnings report. I want to see support and I will sell out of the money bullish put spreads. I am expecting more market selling (SPY $320) so I want to be a little bit cautious this week. Bullish speculators have not been flushed out yet and I feel that the second shoe will drop in the next week. We should test SPY $320 and find support near that level. Strong stocks will weather the storm and we can provide ourselves cushion by selling out of the money put spreads and by leaning on major technical support levels. We need to see two key pieces of information and they will be known by the end of the week. The reaction to major earnings releases in the next few days and the impact/spread of the Coronavirus are key puzzle pieces. We don't need to rush into positions.

Day traders need to keep an eye on SPY $325 support. The first few bars of trading today will be very important. If we start off with long red candles closing on their low, we are going to see more selling pressure early in the day and we are likely the fill-in the overnight gap. If we see 2 or more consecutive long green candles closing on their high in the first few bars we are likely to fill in more of the gap from yesterday. We don’t want these candles overlapping. If the market as a mix of green and red candles in the first hour of trading and if the bodies are relatively small with long tails we know that we are still in a holding pattern. Traders will wait for the news to play out. This is the most likely scenario today since we have major announcements pending. Given the recent upward market momentum I favor trading from the long side if the action is choppy. Look for stocks with relative strength and heavy volume. The only way that I would favor the short side is if the low the day is breached in the first 30 minutes and if I see consecutive non-overlapping long red candles closing on their low.

Be patient, we are only a few days away from clarity. Shortly, we will know exactly how to position ourselves and how aggressive we should be with our options trades.

.

.

Daily Bulletin Continues...