Market Support Is Firm – Keep Scaling Into Bullish Put Spreads [HERE ARE SOME PICKS]

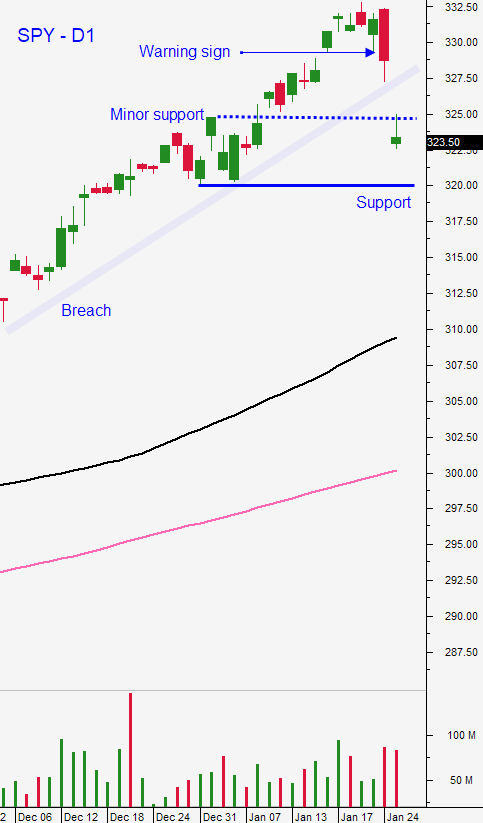

Posted 9:30 Am ET - Yesterday the market rebounded after an early drop and it closed near the high the day. This morning we will probe for support again on concerns that the Coronavirus will have a substantial impact on China's economic growth. Support at SPY $322 is growing and it has been tested multiple times this week.

Earnings season has been good and mega cap tech stock reactions (Apple, Facebook, Microsoft and Amazon) have generally been good. We will hear from Google next week (Feb 3). These tech giants comprise 20% of the S&P 500 and they will determine market direction. Amazon is up almost 10% overnight after posting gangbuster results. At a forward PE of 18, stocks are at the upper end of their valuation range and the headwinds will start blowing in the back half of this earnings cycle. I believe the “air will be let out of the balloon” next week and stocks will struggle to get through the all-time high.

The Coronavirus is spreading, but the WHO is reluctant to label it as an international emergency. It will have an economic impact in China especially since the outbreak occurred during the lunar New Year. China's official PMI's were in line overnight, but they do not reflect the impact of coronavirus.

This week Jerome Powell said that he is concerned about disinflation and the Fed Chairman would consider interest rate cuts if it surfaces. The Fed remains accommodative.

Tonight England will officially leave the EU. This is been a three-year battle and it's finally going to happen. A trade agreement with the EU will be forged sometime this year.

Swing traders should start scaling into bullish put spreads after earnings releases. I am looking for stocks that pull back on a strong number and that establish support above major technical levels (trend lines and major MAs). I am selling bullish put spreads below that technical support and I don't believe the market will have a big drop. Support at SPY $322 is firm and the market bid remains strong. Coronavirus will have an impact, but it is a temporary event and buyers are not overly concerned. I am also looking for stocks that surge higher after earnings announcements. I want to see that opening gap hold for a couple of days and I want to see relative strength in the stock. If I see these characteristics I will sell out of the money bullish put spreads in the gap on the notion that the opening price after the earnings report will hold. These trades require little patience and we need to make sure that the initial reaction is legitimate. Option Stalker has a search called Strong after Earnings. It looks for this pattern and I will be using it to find bullish put spreads.

.

.

SWING TRADES FOR FRIDAY - BULLISH PUT SPREADS [VIDEO]

.

.

.

Day traders should look for opportunities to buy this morning. Let the market come in and wait for support - watch SPY $322. Given the bounces this week I believe the selling will quickly run its course today. If the market grinds higher like it did yesterday we will have some option lotto trades setting up later in the day. I look for strong stocks with relative strength, heavy volume and liquid options. Option Stalker helps me identify the stocks late in the day and I buy call options for pennies just before they expire in the last 30 minutes of trading. These option lotto plays have limited risk and huge upside potential. The key is to buy at the money options that have a high probability of going in the money. Once they do that the options trade at intrinsic value. This is a low probability trade and the key is finding the right stocks and being extremely patient. A good entry point is critical.

Look for more nervous jitters early in the day and buying the rest of the day. The soft patch should run its course in a week or two and I believe the market will establish a trading range between SPY $320 and $335 for the next two months. Stocks need time to digest gains and to grow into valuations. SPY $322 is a key level to watch. That support needs to hold. $320 is a more significant (horizontal support).

.

.

Daily Bulletin Continues...