Market Should Find Temporary Support Today – Here’s Why – Backdrop Very Weak

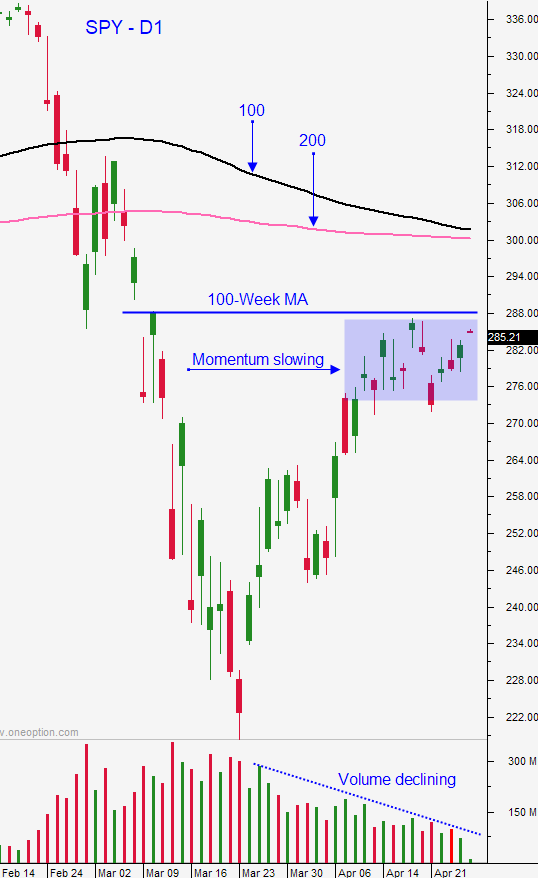

Posted 9:30 AM ET - Last week the market was above technical support at SPY $288 on the eve of mega cap tech earnings. The reaction would determine if the S&P 500 was able to rally to 3000 and challenge the 200-day moving average. Results from Microsoft, Facebook, Tesla and Twitter were excellent, but the market retreated. Thursday the market had a chance to redeem itself on earnings from Apple and Amazon. The reaction Friday was bearish and the market fell below support at SPY $288. Last week's selling pressure was a sign that stocks are ready to roll-over and the selling pressure is heavy.

Earnings season is front-end loaded and the strongest companies report results early in the cycle. Many of the tech giants benefited from the virus and the quarter ended before the economic shutdown really got going. Companies that report from this point on will include more data from the Coronavirus. Additionally, sectors that were hit particularly hard will be reporting in the next few weeks. Almost 1/3 of the S&P 500 companies will report earnings this week.

Federal stimulus checks have been sent out to 187 million Americans and for most people this is a very small bridge loan. In a recent poll, half of the respondents are not able to afford May's rent. Another poll reflected that 57% of respondents feel that some form of the shutdown will exist for another six months and that the virus will continue to be a healthcare problem. That was a stark increase from 14% a few weeks ago. I don't put a lot of credence into polls, but these findings are consistent with my observations when I talk to people and when I go shopping.

The economic recovery needed to start immediately and we are a few days into the month without any noticeable changes. Each week that consumers continue to "hanker down" makes the economic recovery exponentially more difficult. Just because workers return to their jobs doesn't mean that they will open their wallets. They will watch to see if orders/foot traffic returns to normal and they will gauge their job security. If they feel that the recovery is tenuous they won't spend money. Auto sales are expected to decline 27% this year and dealers are sitting on a mountain of inventory.

Last week's FOMC statement was as dovish as it could be. Central banks are printing money like mad and the ECB is now accepting junk bonds as collateral. This quarter, banks in the US and Europe are on pace to write down $50 billion worth of bad loans.

I could continue to spew out facts and statistics that support my bearish bias, but I don't see the benefit of doing it. We all sense what's going on and the recovery will be long and hard. Credit has been at extreme levels and it covers the entire spectrum from consumers all the way up to governments. This house of cards has been built over decades and what would've been a speedbump 30 years ago is now a crisis (because of high credit and low savings rate). Credit is the one thing that needs to be watched very closely. I believe that we are going to start seeing some major issues in the next few months as the recovery takes longer than expected.

Swing traders are short a full SPY position at $287.We sold 1/2 position 10 days ago when the market hit our first target of $288 and last Friday we were able to add to the position at $286 right on the open. The bad news should start mounting shortly when consumers stay sidelined. This week we will focus on selling out of the money bearish call spreads. Earnings season will provide us with some excellent opportunities.

Day traders should expect a fairly quiet trading day. The market is closed in China and Japan for holiday and this usually reduces activity in the US. The selling pressure last week is spilling over and we will test the downside early today. Wait for market support and look for relative strength. The S&P 500 was down 50 points overnight and now it is only down 20 points. That tells me that there is a little buying pressure and that we could see a nice bounce this morning once the lows are in. Beginning-of-the-month fund buying should provide a bid. Look for stocks with relative strength early this morning and wait for support. Once it's established, buy these stocks and set passive targets. We should get a nice run in the morning and then we will wait to see what the rest of the day has in store. We have been making almost all of our money in the first two hours of trading and I will trim my size and activity in the afternoon session.

Look for weak price action during earnings announcements the next few days. ISM manufacturing, ADP and the Unemployment Report will be released this week and dire results are expected.

.

.

Daily Bulletin Continues...