Look For A Bounce Today – Should Be Some Decent Option Lottery Trades

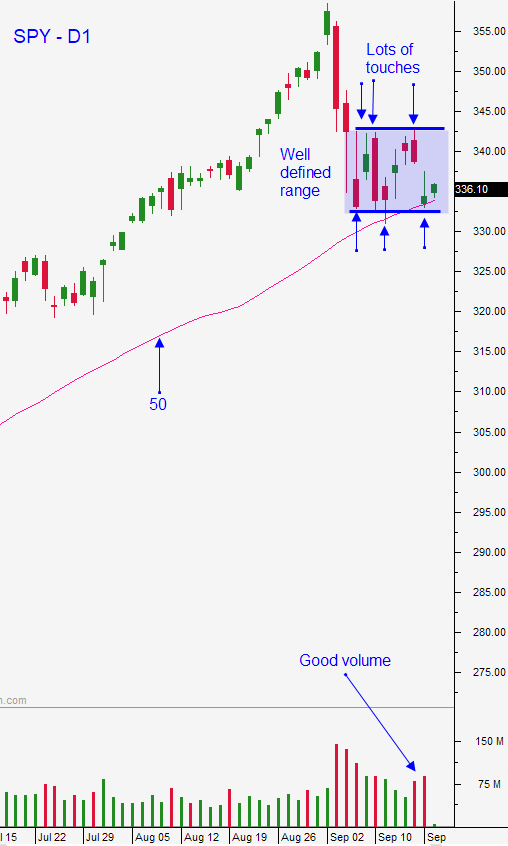

Posted 9:30 AM ET - Yesterday the market gapped down to a major support level that has been established over the last three weeks and it was able to hold its ground. Buyers and sellers are paired off and we are seeing choppy price action between SPY $332 and $342. Stocks are rich at a P/E of 23 and they need time to grow into current valuations. The market could tread water in this range for a few months or it could correct and then rally back. The current price action will help us determine which scenario will play out.

If the market is able to breach support at $332 in the next week it will test SPY $324 or possibly $317. Current valuations are stretched and the economic recovery has been hampered by the second wave of the Coronavirus. Europe is going through its second wave and much of the continent is shutting down. The Fed is worried about bank balance sheets and it will conduct another stress test. The Fed is considering an extension of its curb on stock buybacks and dividend payments by financial institutions. It wants banks to preserve cash. According to the National Restaurant Association, 60% of the restaurants (100,000) that closed their doors during the pandemic will never reopen. This industry employs 8% of the workforce and this is significant. Initial jobless claims have been averaging 900,000 per week during the last month and that is a concerning level. These are definitely stiff headwinds.

Buyers are still engaged because fixed income yields do not keep pace with inflation. Bond investors have negative real returns. Stocks still represent an attractive investment alternative for those with a long-term perspective. Asset Managers know that they might have to ride out a few bumps, but that ultimately the economy will recover. Domestic new cases of the virus are declining and the prospects of a vaccine in the next six months are encouraging. On a very short-term basis, the government will be able to avoid a shutdown if a budget agreement is not reached (Sept 31). Experts say that they will be able to kick the can down the road until December. Hopefully the election results will be known by then.

The crosswinds are very stiff and longer-term traders need to be patient. If support at SPY $332 survives the next two weeks it will solidify and we can consider selling out of the money bullish but spreads. If that level fails we need to wait for support. Because we trade options, our positions are highly leveraged. We don't have the luxury of "riding out a storm" like long-term stock investors can. Consequently, cash is king. This market rally has lasted 11 years and it is extremely strong. If we do get a market pullback, it won't last long and it will provide us with a fantastic entry point.

Day traders are nimble enough to take advantage of very short-term moves. Given that the market held support the entire day yesterday, I believe that we will see a buying opportunity today. Quadruple witching always adds a little volatility to the mix so expect the extremes of a wide range to be visited a couple of times. Heavy Buying is my favorite Option Stalker search on the opening bell. Once the price action settles in I also use PopBull and Relative Strength 30 if there has been a market dip. After an hour of trading I also start looking at Bull Run. The 1OP indicator dictates my actions. It tells me when to buy, when to take profits on long positions, when to short and when to take profits on my short positions. This is the normal routine and we should see some decent price action today. I will also be looking for option lottery trades in the last hour. I suspect that we might see some on the bullish side.

Support is at $333 and resistance is at $337.50. I expect that range to hold today.

.

.

Daily Bulletin Continues...