Market Has the Perfect Backdrop For A Melt-up and We Have Technical Confirmation

Posted 9:30 AM ET - The market made a new all-time high yesterday and the snapback rally this week was so strong that I believe we could see a market melt-up. I primarily look at price action for my decision-making and I've been mentioning how strong the buying pressure is. As I look back at a week filled with information, I can also make a fundamental argument for higher prices.

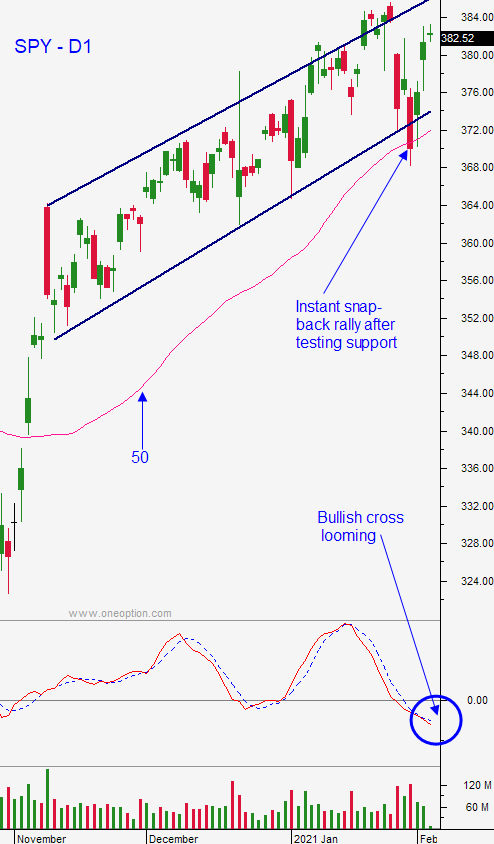

From a technical standpoint, last week's decline was the strongest we've seen in months. We tested the lower end of the trading channel and we closed below the 50- day moving average. Typically, that type of price action would retest the lows once more before moving higher and that didn't happen. From the time the opening bell sounded Monday, the market shot higher like a cannon ball.

From a fundamental standpoint, we have seen raised guidance by many companies during earnings season. Profits are only down 2.5% year-over-year and considering the backdrop that is a major victory. This week's economic data (ISM manufacturing, ISM services, and ADP) were solid. This would normally be a "good news is bad news" scenario because it would mean that the Fed would be close to tightening as activity strengthens. FOMC officials said that they will maintain lose monetary policies through 2022. Treasury Secretary Janet Yellen and Democrats want to "go big" with a stimulus bill. The Senate drafted a blueprint yesterday and it passed. The House is likely to approve it. This is a perfect backdrop for a market melt up.

We know that retail investors are "all in". We saw that in the short squeezes last week and margin borrowing is at an all-time high.

In my swing trading comments yesterday I advised buying on the open and adding if we made a new all-time high. Swing traders should have a full position. These instructions are generic and my pre-open market comments are posted on the Internet. 1Option members get specific instructions sent by email. This morning I recorded a video and we are going to buy calls for the first time in many months. Option premiums are extremely low and we are buying in the money options that expire in more than a month that have a high Delta.

Day traders should watch the early action and favor the long side. Support is at SPY $385.80. We are likely to see some bid checks during the day. The best tactic will be to hawk relative strength during those dips and to buy once support is established. Use the 1OP indicator as your guide. Heavy Buying, Relative Strength 30 and Bull Run are the go to searches.

Get ready for another leg higher.

.

.

Daily Bulletin Continues...