Market Rally Getting Too Hot – Watch For These Warning Signs

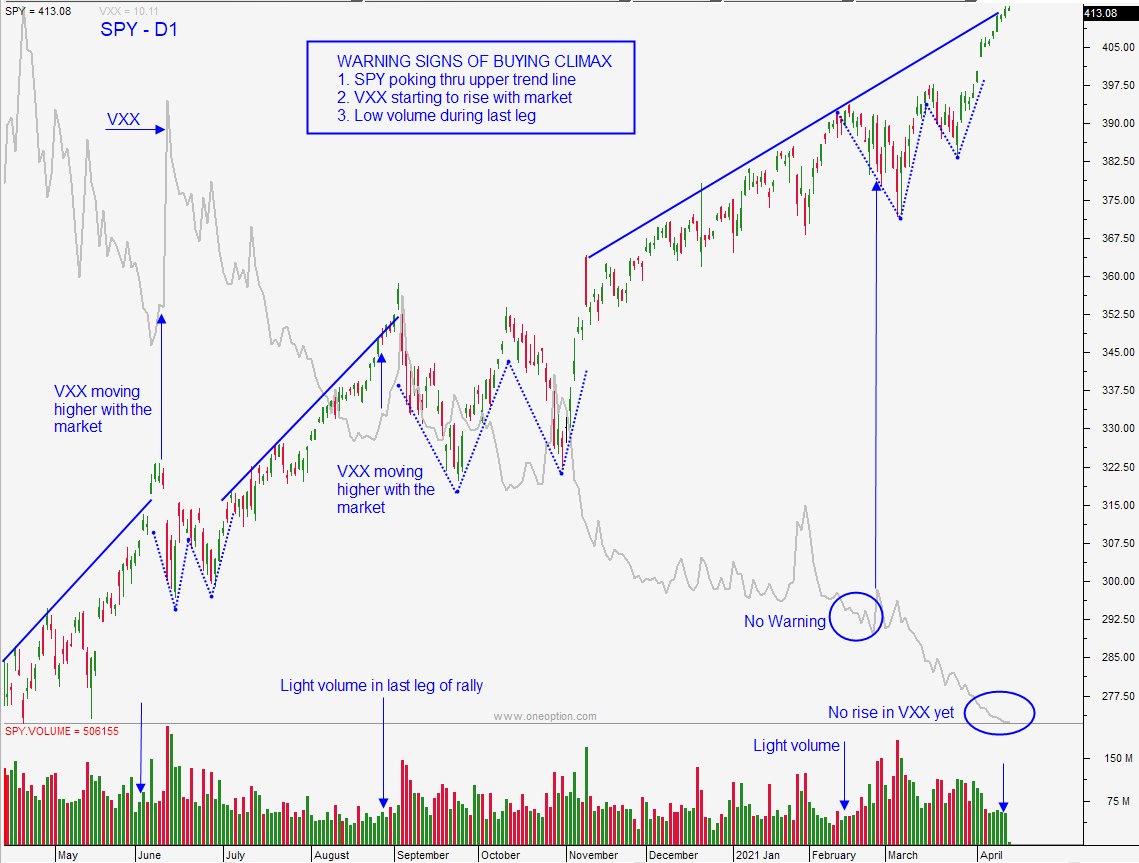

Posted 9:30 AM ET - The market continues to surge higher and this certainly feels like a buying climax. Ride your positions and start taking some profits. Earnings season has started and the reaction to J.P. Morgan Chase and Goldman Sachs was good. The market bid should remain strong into tech earnings the next two weeks and today I've outlined some warning signs to watch for.

Banks will dominate the early releases and this is a good environment for them. Cash deposits are up 25% year-over-year and credit risk is low. Some of that money will find its way into the market and some will be spent. There is an estimated $2T on the sidelines. Interest rates have moved a little higher and a job recovery is underway. Both are good for banks. Q1 guidance was much better-than-expected and profits should be robust this quarter. Guidance for Q2 should also be excellent as states reopen. With another quarter of profits under our belt, valuations will start to normalize.

The Fed will not raise rates until 2024 and strong economic numbers have sparked buying.

The biggest market threat is a melt-up. We are getting close to those levels and it could spark profit-taking. The S&P 500 has reached the upper trend line (connect the highs) and that is the first warning sign. Trading volume has been light and that is another red flag. Buyers are not aggressive and light volume suggests a low level of conviction. Option implied volatilities typically plunge in the last leg of the rally and we are seeing that. Sometimes (but not always) we will see an uptick in VXX just before the market decline. Late day selling and a close on the low of the day is another warning sign if we have follow-through the next day.

Swing traders should raise their stop on SPY to $410 on a closing basis and set a target of $420. This is been a nice run for us and we are going to take profits. Bullish put spreads should be performing well and you should buy them back for pennies when they get that cheap. Do not add to your positions at this level. We need to wait for a pullback and then we can reload. I am not bearish on an intermediate basis; I just feel that we will have a better entry point if we are patient. The market has been in a stair-step pattern and we are due for a pullback. This move has come very quickly and that makes it vulnerable to profit-taking. Please review the chart below.

Day traders should continue to look for opportunities on both sides of the market. I still prefer to trade from the long side and to buy dips. Stocks that are breaking through major moving averages and horizontal resistance on heavy volume have been making sustained directional moves. Ride the momentum and watch for the warning signs above.

Support is at SPY $410 and resistances at $420.

.

.

Daily Bulletin Continues...