Big Tech Earnings After the Close – Watch the Reaction

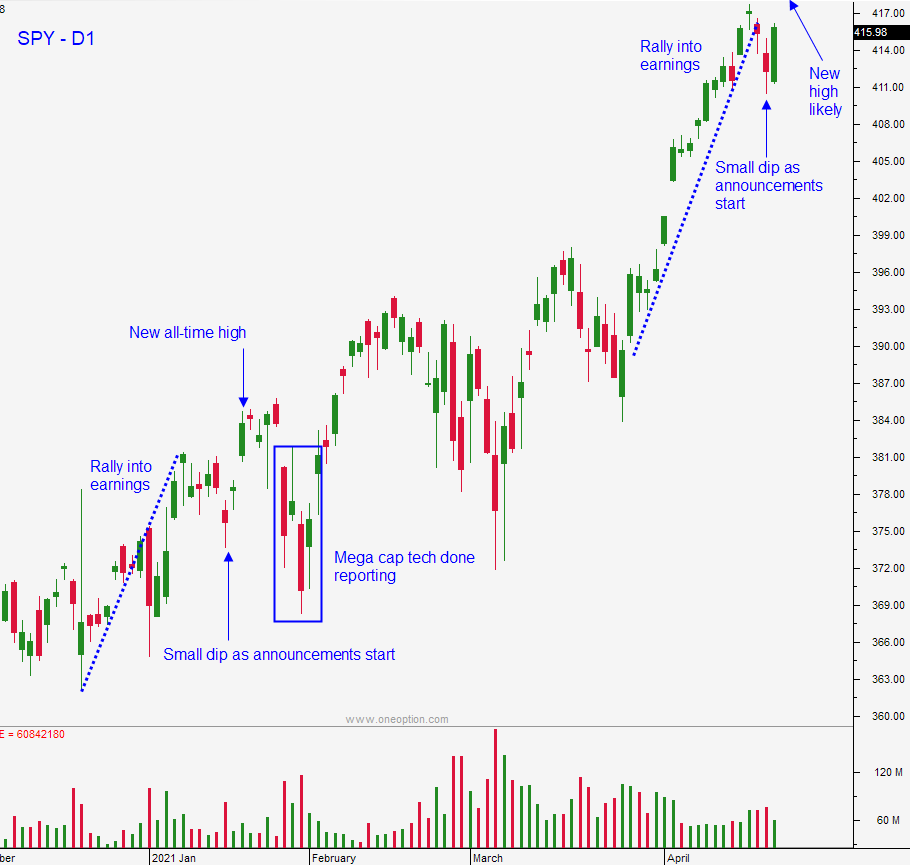

Posted 9:30 AM ET - The market has been in a holding pattern for the last week and it is sitting right at the all-time high. Traders are waiting for earnings releases and they will climax this week. Tech giants will start reporting today and they will set the tone for the market. Fantastic results are expected and we will see if there's any gas left in the tank.

Earnings have been robust so far and more than 1/4 of the companies in the S&P 500 have reported. On average, earnings expectations have been exceeded 84% of the time and revenue growth has been exceeded 77% of the time. We haven't seen "beats" like this in over a decade.

Tesla reported after the close yesterday and profits were better-than-expected. The stock is down 2% and that demonstrates that exceeding estimates does not necessarily mean the stock will move higher. Microsoft, Google and AMD will report after the close today. Apple and Facebook will report Wednesday and Amazon will report earnings Thursday. By the end of the week we will have heard from the majority of the companies in the S&P 500.

Buyers tend to be very engaged ahead of tech earnings and I believe that we will see that excitement wane next week. We saw a similar pattern in January and I believe that any dip will present a buying opportunity once support is established. The market has been in a trading channel and we've seen a stair-step pattern. Now that the market has taken three steps forward, it is likely to take a couple of steps backwards. I am not looking for a big decline, just a better entry point for longs. Bullish speculation is very high and some of those "weak hands" will be flushed out. The dip will be brief and shallow so have your shopping list ready.

Next week we will also get major economic releases. The news should be excellent. There is no threat of Fed tightening so we are in a “sweet spot”. States are reopening and in many areas vaccinations no longer require an appointment (walk-in). We have reached 3 million vaccinations per day and this will help to curb the spread of the Coronavirus.

Stock valuations remain rich and swing traders do not need to chase this market. Wait patiently on the sidelines for a dip and spend your time looking for stocks that have strong earnings reactions. We want breakouts through horizontal resistance and relative strength. When we get the market dip stocks that hold the breakout will confirm that they are poised to move higher.

Day traders should look for opportunities on both sides of the market. There have been excellent longs and shorts in the last few weeks. Sector rotation has been brisk even though the market has not moved much. We are finding excellent short squeezes to day trade. Make sure to use the Option Stalker Short Squeeze variable in Custom Search and combine that with Heavy Volume Today and s Stock > Prior Day's High variables. This has produced 5-6 high quality trades per day with big percentage moves. We are right at the all-time high so I am favoring the long side.

Support is at SPY $414 and resistance is at $418 and $420. I expect us to get through $420 this week.

.

.

Daily Bulletin Continues...