Slow Day Ahead – Traders Will Wait For Major Economic News

Posted 9:30 AM ET - Yesterday the market opened at a new all-time high and those gains were quickly erased. As I mentioned in my pre-open market comments, those moves are typically faded. When we have a gap reversal off of a new all-time high there tends to be follow-through selling for a few days. The price action today will be fairly light ahead of major economic releases.

Stock valuations are rich and another quarter of healthy profits will bring them back to a more normal level. Inflation worries will take time to resolve and many analysts believe that the Fed's forecast is too conservative. The Fed may have to discuss a timeline for tapering and tightening of any kind will spark profit-taking. China's market is in bear territory and I don't believe the S&P 500 will break out until we see traction in Asia. The FXI did close above the 200-day MA so we might be seeing some improvement. These forces are keeping a lid on the market.

Domestic economic conditions are improving rapidly. ISM manufacturing was above 61 yesterday and that is an incredibly strong number. ISM services and ADP will be released tomorrow. I'm expecting robust numbers. The Unemployment Report will be posted Friday and I'm expecting a big upward revision to April's number. Europe is starting to reopen and that will keep buyers engaged. Dips will be brief and shallow and these forces are providing a strong market bid.

The opposing market forces are strong and I believe the S&P 500 will stay in a trading range between 4000 and 4200 for at least a month. Don't chase rallies, buy dips.

Swing traders should be on the sidelines waiting for the next market drop. Have your bullish stocks ready because you won't have more than a day or two to enter your bullish put spreads. Stocks with relative strength and heavy volume that are breaking out through technical resistance are your best plays. Sell the out of the money bullish put spreads below technical support and let accelerated time premium decay work its magic. This is a light new cycle and we are heading into the summer doldrums.

Day traders should take advantage of sector rotation. Energy stocks and financials have been hot and yesterday we saw some action in Chinese stocks. This list changes daily and Option Stalker searches help us find the best day trading opportunities. I don't believe that the market will have a sustained rally until the downside is tested. Yesterday's gap reversal reveals selling pressure and buyers will be relatively passive until support has been confirmed. This is a low probability trading environment and you should trim your size and your trade count. The action will improve Thursday and Friday when we get major economic releases.

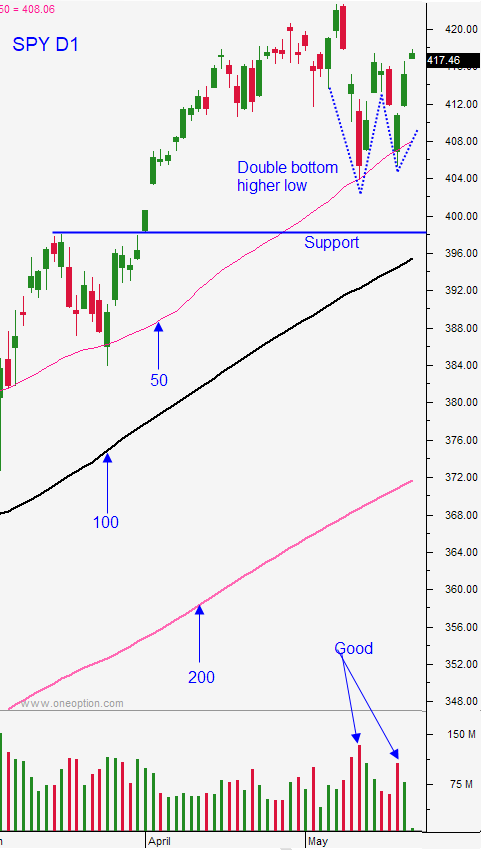

Support is at SPY $418 and resistance is at $422.

.

.

Daily Bulletin Continues...