Market Direction Will Be Determined In the Next 2 Weeks – Watch For This

Posted 9:30 AM ET – The market could swing either way in my opinion and this is a low probability trading environment for swing traders. The price action during the next week is critical and it will provide clues on where we go from here.

On the bullish side of the ledger the same theme has been playing out for years. Bond yields do not keep pace with inflation (negative real returns) so investors are piling into stocks. Corporations are facing rising raw material costs, labor shortages and supply disruptions. The best investment for many of them is share buybacks and that is also keeping a bid to the market.

On the bearish side of the ledger, stock valuations have not been this high since the tech bubble of 2000. China may have credit issues with the failure of Evergrande and the world is waiting to see how China responds. Electricity is in short supply in China and they are rationing it. This will impact manufacturing. Their market is in bear territory and it is within striking distance of the 52-week low. The Fed will start tapering and the market will not like it when they take the punch bowl away. September is a seasonally weak month.

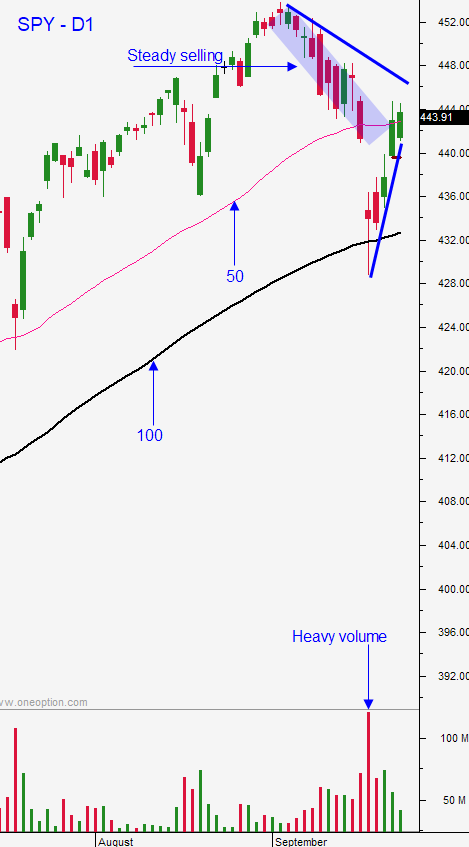

From a technical standpoint we have seen the heaviest selling in a year. That tells me that we are likely to probe for support one more time. That test will result in one of two outcomes and it will determine our swing trading for the next month. The SPY could make a higher low double bottom above the 100-day MA. That would excite buyers and we would grind higher into year end. Alternatively, the market could take out the 100-day MA as recent “dip buyers” get flushed out. Buying dips has been a very successful strategy in the last year and this trade is very crowded (that means the selling pressure will be heavy when bullish speculators exit).

Swing traders need to be cautious. Last week you may have dipped your toe in the water when I suggested selling a few out of the money bullish put spreads. Keep them on a tight leash and use the 50-day MA as your guide. We want to close above it. Also make sure that the stock is maintaining its relative strength to the SPY. I would not add to positions until we have confirmed support (double bottom higher low).

Day traders should also use the 50-day MA as a guide. The futures overnight were positive and they have slipped into negative territory before the open. I sense that we will see selling pressure early and the 50-day MA will be tested. I am also using the daily up and down trend lines that have formed the last two weeks as a guide. Friday was an “inside day” and the first hour range was intact for most of the day. We are seeing mixed green/red candles indicating a lack of market direction. Be flexible and watch for two-sided price action today.

Support is at the 50-day MA and $440. Resistance is at $444 and $447.50

.

.

Daily Bulletin Continues...