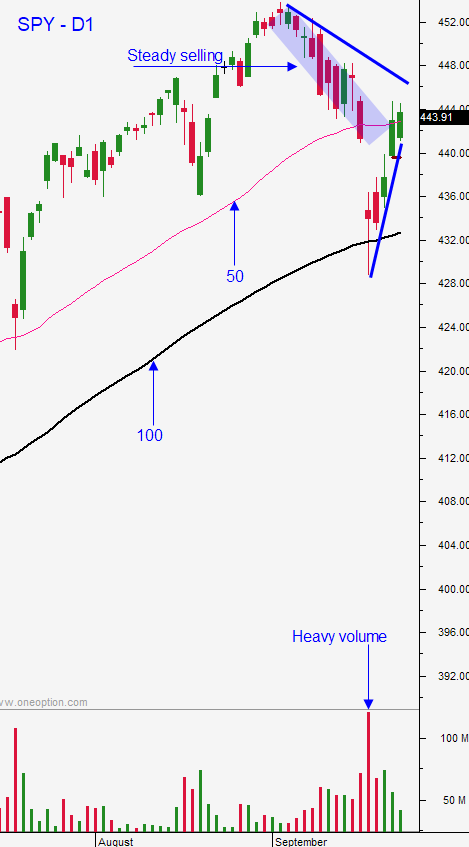

Don’t Trust the Market Bounce This Morning – The Selling Has Been Steady

Posted 9:30 AM ET - I view the price action yesterday as more bearish than bullish. All of the losses from Tuesday were preserved and the market closed just above the 100-day MA. In the last year, buyers have aggressively bought dips. This suggests that they are either holding off on purchases or that Asset Managers are reducing risk (selling). In either case, it is too early to buy this dip.

On the bullish side of the ledger the same theme has been playing out for years. Bond yields do not keep pace with inflation (negative real returns) so investors are piling into stocks. Corporations are facing rising raw material costs, labor shortages and supply disruptions. The best investment for many of them is share buybacks and that is also keeping a bid to the market.

On the bearish side of the ledger, stock valuations have not been this high since the tech bubble of 2000. China may have credit issues with the failure of Evergrande and the world is waiting to see how China responds. Electricity is in short supply in China and they are rationing it. This will impact manufacturing. Supply disruptions are surfacing everywhere and this will add to the problem. China’s market is in bear territory and it is within striking distance of the 52-week low. The Fed will start tapering and the market will not like it when they take the punch bowl away. September is a seasonally weak month and TLT is below the 100 and 200-day MAs.

From a technical standpoint we have seen the heaviest selling in a year. The test of the 100-day MA will result in one of two outcomes and it will determine our swing trading for the next month. The SPY could make a higher low double bottom above the 100-day MA. That would excite buyers and we would grind higher into year end. Alternatively, the market could take out the 100-day MA as recent “dip buyers” get flushed out. Buying dips has been a very successful strategy in the last year and this trade is very crowded (that means the selling pressure will be heavy when bullish speculators exit).

Swing traders need to be cautious. Last week you may have dipped your toe in the water when I suggested selling a few out of the money bullish put spreads. Keep them on a tight leash and use the 50-day MA as your guide. We want to close above it. Also make sure that the stock is maintaining its relative strength to the SPY. I would not add to positions until we have confirmed support (double bottom higher low).

Day traders should favor the short side. I do not believe this early gap up is going to hold. The best trading scenario for me will be a wimpy rally on the open with tiny bodied candles. When the rally stalls I will be looking for signs of resistance at SPY $437. Ideally, 1OP will spike and in 30 minutes with a bearish cross and there will be candles with tails above body (wicks). If I see that I will start shorting. The selling pressure has been steady and we will test the downside today. Alternatively, we could see a gap reversal. That would be a sign of heavy selling pressure. You will see long red candles stacked (little to no overlap) in the first 30 minutes. That level of selling would test the 100-day MA it would fail today. The most likely scenario is somewhere in between. We are likely to compress and try to hold the gains or gradually drift lower. If this unfolds I will monitor the price action. Mixed tiny candles would indicate that we could be range bound again today. Yesterday was an “inside day” and we were trapped in the first hour range the entire day. That set-up is horrible for day trading and if you see it again you need to trim your size and trade count to almost zero.

Support is at the 100-day MA and resistance is at $437 and the 50-day MA.

.

.

Daily Bulletin Continues...