Trade Cautiously Ahead of the FOMC Minutes Today – Tapering Timetable Important

Posted 9:30 AM ET - The S&P 500 is weak and it closed below the 100-day MA for the second straight day. This is a sign of steady selling pressure. The debt ceiling was extended to December 3rd so this issue has not been resolved. Watch for an early action today and then dull trading as we wait for the FOMC minutes.

I’ll keep this brief. We had a weak jobs number last Friday and “hot” hourly wages. We also have a spike in commodity prices. Soft economic growth and higher prices are sparking talk of stagflation (bearish). The FOMC minutes today are not usually a big market mover, but they could be today. Traders want to gauge where Fed officials stand on tapering and they will be looking for any clues that it will start at the next meeting (Nov 2). The market is addicted to easy money and it could have a “taper tantrum”.

Earnings season starts today and banks will dominate the early scene. With interest rates rising, the reaction should be positive. Analysts have been downgrading earnings projections at a fast clip and the forward P/E on the S&P 500 has not been this high since the 2000 tech bubble.

Chinese credit issues have quieted down for the moment, but I suspect there are big issues. When the tide goes out (slowing economy), we get to see who is wearing a swim suit. I will be watching for other defaults in China.

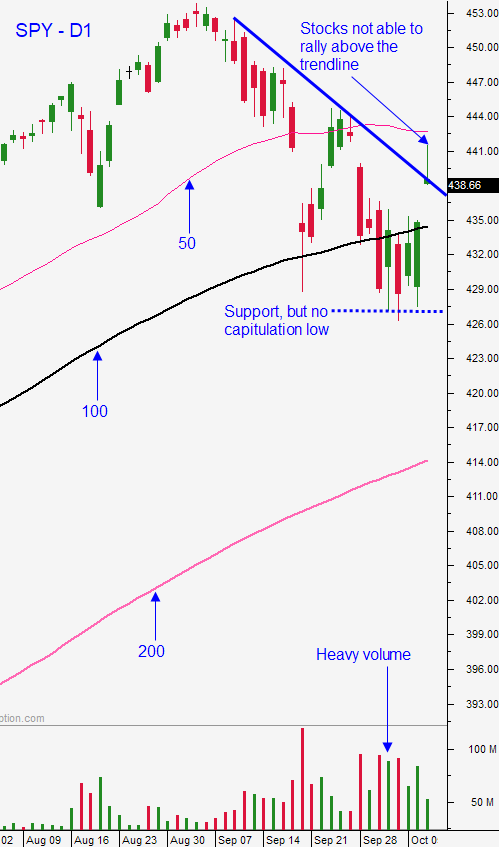

Swing traders with a 3-4 week time horizon should stay in cash. Don’t buy until the SPY closes above the downward sloping trend line on a daily chart (approximately SPY $438).

Day traders should stay very fluid. Expect two-sided price action and don’t get locked into a directional bias. The selling pressure has been heavy. Use the 100-day MA as your guide. We have 2 consecutive closes below that support level that is bearish. The action could be decent for the first two hours. I am expecting a nice little rally and then a drift back down as we wait for the FOMC minutes. If it looks like tapering will start in November, the market will drop. If it will not start until 2022, the market will rally.

The Fed knows that inflation is running “hot” and the CPI came in above expectations this morning. Even if they do not want to taper, their hand will be forced by inflation.

Support is at SPY $428 Resistance is at the 100-day MA.

.

.

Daily Bulletin Continues...