Here’s How I Will Trade the Market Gap Up Today!

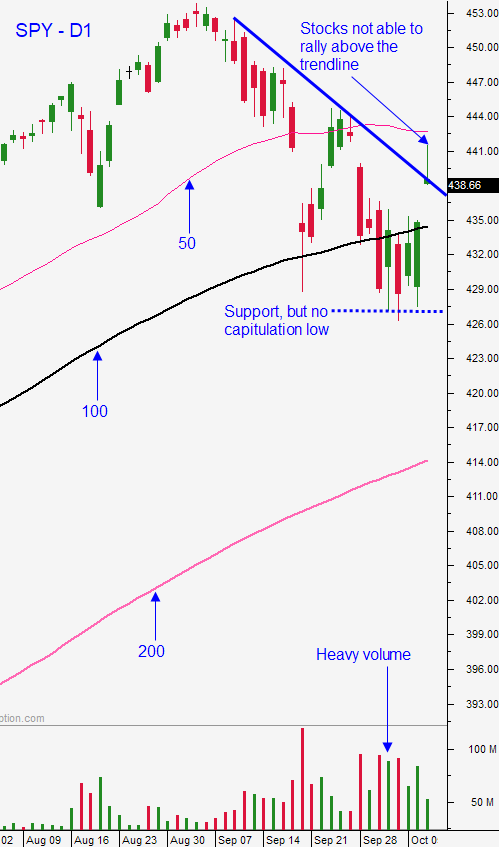

Posted 9:30 AM ET - The S&P 500 has been finding support around the 100-day MA. The FOMC minutes did not provide any new information and the market barely moved on the release yesterday. There was not any overnight news to justify the big gap up this morning. Earnings season is starting and that typically attracts buyers. The down trend line on a daily chart comes into play at SPY $439 and we will test it this morning. A close above it would be bullish.

Reasons to be bullish:

1. Interest rates are not keeping pace with inflation (negative real returns) so investors see stocks as an attractive investment alternative.

2. Corporate buy backs are steady.

3. The long term trend is up and the market formed a base at the 100-day MA.

4. We are heading into a seasonally strong period.

Reasons to be bearish:

1. Stock valuations have not been this high since the 2000 tech bubble.

2. The Fed may start tapering in November.

3. Hourly wages are rising quickly and this will bite into profit margins.

4. Raw material costs are rising quickly and that is inflationary.

5. Global economic growth is sluggish because of supply disruptions.

6. Electricity is being rationed around the globe due to energy supply issues.

7. China is seeing a rise in corporate defaults. This could spark credit concerns.

8. Analysts are downgrading earnings expectations at a fast clip.

9. This is the heaviest selling we have seen in a year.

The market is priced for perfection and as you can see from the list above, this is NOT a perfect backdrop. These are very strong opposing forces and I believe we will see sideways trading in a wide range.

Swing traders do not need to chase this opening gap higher. I believe there will be chances to buy. I suggest selling out of the money bullish put spreads on strong stocks. Don’t go crazy; just dip your toe in the water. This strategy will allow you to distance yourself from the action and to take advantage of time decay. Sell the spreads below technical support. I do not want to get more aggressive with longs until we close above SPY $439 and we hold that level for a day or two.

Day traders need to be careful on the open. This gap up came out of nowhere so I do not trust it.

If we see stacked green candles in the first 30 minutes I will try to scalp a few strong stocks that are breaking out, but I will be relatively passive (small size). That would be a gap and go formation through the downward sloping trend line.

If the market compresses during the first 30 minutes and it holds the gains I will be a little more aggressive because I will not be forced to chase. I will have time to evaluate stocks and to search for relative strength.

If the market gradually drifts lower with mixed green and red candles in a choppy fashion I will be aggressive when we find support. Relative strength will be super easy to spot and the price action in the SPY would suggest that buyers are still engaged, we just have to find support. This would be the best scenario because it provides an excellent entry point for longs and it gives us time to evaluate the price action.

If I see long red candles stacked on the SPY with very little overlap in the first 30 minutes I will be looking to short ES/SPY. This would be a gap reversal and we will fill in more of the gap. I prefer shorting futures because the trade is easier to manage and I suspect that once support is established I will have to take profits quickly. It is easier to do that with 1 position vs 4-5 stock positions.

Stay fluid and know that the opposing market forces are strong. We will see two-sided price action.

Support is at the 100-day MA. Resistance is at $439 and the 50-day MA.

.

.

Daily Bulletin Continues...