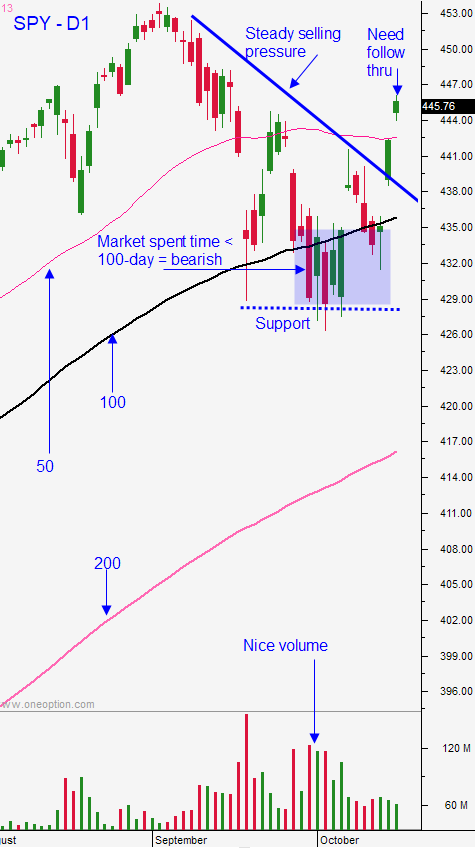

Market Looks Good – But It Needs To Hold This Critical Level This Week

Posted 9:30 AM ET – Earnings season will kick into high gear in the next week and traders will be focusing on guidance. Year-over-year comps will be harder to beat since we were starting to come out of the depths of Covid-19 and stock valuations have not been this high since the “tech bubble” of 2000. This morning the 50-day MA will be tested and if it fails the rally last week will be viewed as a temporary bounce. If it holds, the market will try to grind higher later in the week.

The same market forces that were in play early in the week are still present.

Reasons to be bullish:

1. Interest rates are not keeping pace with inflation (negative real returns) so investors see stocks as an attractive investment alternative.

2. Corporate buy backs are steady.

3. The long term trend is up and the market formed a base at the 100-day MA.

4. We are heading into a seasonally strong period.

Reasons to be bearish:

1. Stock valuations have not been this high since the 2000 tech bubble.

2. The Fed may start tapering in November.

3. Hourly wages are rising quickly and this will bite into profit margins.

4. Raw material costs are rising quickly and that is inflationary.

5. Global economic growth is sluggish because of supply disruptions.

6. Electricity is being rationed around the globe due to energy supply issues.

7. China is seeing a rise in corporate defaults. This could spark credit concerns.

8. Analysts are downgrading earnings expectations at a fast clip.

9. This is the heaviest selling we have seen in a year.

The market is priced for perfection and as you can see from the list above, this is NOT a perfect backdrop. These are very strong opposing forces and I believe we will see sideways trading in a wide range.

Swing traders can dip their toe in the water by selling put of the money bullish put spreads. This strategy will allow you to distance yourself from the action and to take advantage of time decay. Sell the spreads below technical support. If the market is able to hold the gains from yesterday for a few more days, you can add to your bullish put spread positions. I am still expecting two sided price action and I will not get more aggressive with longs until we can close above the 50-day MA for a few days.

Day traders should wait for the market to find support this morning. Gaps down are my favorite pattern on the open. If you see consecutive stacked green candles with little to no overlap in the first 30 minutes you can buy aggressively. If we have a mix of green and red candles (likely) in the first 30 minutes, search for stocks with relative strength that are breaking through technical resistance on heavy volume. Wait for the market to find support. If the selling pressure is steady early in the day, we could test the 50-Day MA and you should hold off on longs until we test it. If the market finds support early and you see bullish hammers or bullish engulfing candles off of the low of the day you can start buying earlier. As always use 1OP as your guide for the market.

I liked the price action last week and it has me leaning bullish this week especially with earnings season cranking up. The bid should remain strong through mega cap tech earnings. I am not aggressively buying on the notion that this is the start of a year-end rally that will take us to new all-time highs. The price action during the last 6 weeks suggests that the selling pressure is relatively stiff and gains will be hard fought. I am selling some bullish put spreads a few weeks out and I am primarily day trading.

Support is at the 50-day MA. Resistance is at $446.25

.

.

Daily Bulletin Continues...