Market Is Bipolar – Great For Day Trading But Not For Swing Trading

Posted 9:30 AM ET - This has been a volatile week of trading and the take away is that buyers and sellers are paired off. The market will open today right where it opened Friday. If you are just getting back from your Thanksgiving you missed a lot of “noise”. There are great day trading opportunities, but I would keep swing trades to a minimum.

This morning ADP reported that 534,000 new jobs were created in the private sector. That was slightly better than expected. ISM manufacturing will be posted after the open.

China’s manufacturing activity (Caixin) fell back into contraction territory in November (49.9).

Fed Chairman Powell said that inflation is more than transitory and that spooked investors yesterday. He also hinted that tapering will happen at a faster pace than expected.

Considerations:

1. Gains from light volume rallies are easily stripped away.

2. Year-end seasonal strength is likely to keep the dips brief and shallow.

3. No one knows if the new variant is more contagious and we do not know if the vaccines will fight it.

4. The credit crisis in Turkey reminds us that many sovereigns are sitting on mountains of debt. Turkey’s credit crisis should not have much of a ripple effect.

5. Goldman Sachs has been very dovish and they were not expecting any rate hikes in 2022. This was their stance just a month ago. Now they are talking about tapering at double speed and 3 possible rate hikes in 2022. This is a complete pivot and the FOMC meeting on December 15th could be a speed bump.

6. Stock valuations have not been this high since the 2000 tech bubble.

What does all of this mean? From a short term trading viewpoint (less than a month) it is another sign of uncertainty and two-sided price action. I have been mentioning for weeks that the opposing forces are very strong and that this is a low probability trading environment. Central bank tightening, global credit concerns, persistent inflation (not transitory) and complacency (confirmed by a low VIX) are potential spoilers for a year-end rally.

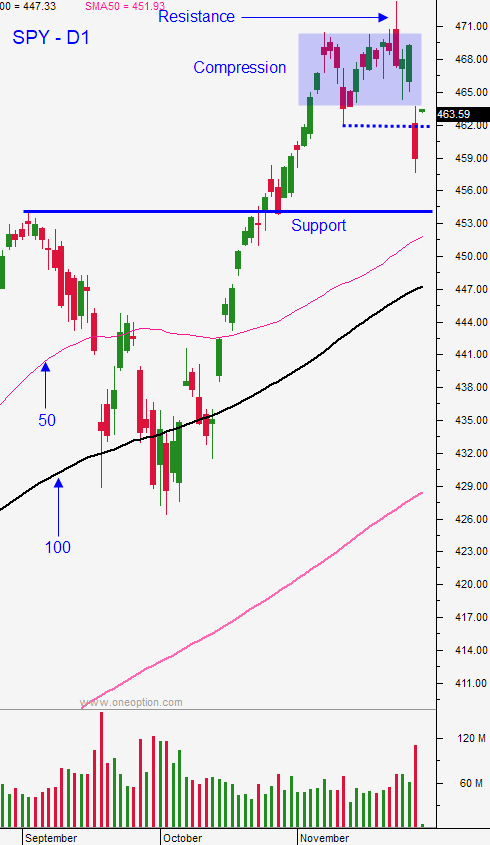

How should swing traders react? Yesterday we got the retest of support that we were expecting. If the market is able to hold most of the gains today, sell a handful of OTM bullish put spreads. Choose wisely and sell the spreads below technical support. Be passive with swing trades that last more than a couple of weeks.

What should day traders do?

Overseas markets were fairly strong so that will provide a springboard this morning. Beginning of the month fund buying will also support prices. I will monitor the action this morning and I will NOT chase the rally. If it is a “gap and go”… I will miss those gains. I prefer to sit back and watch the price movement so that I can gauge strength. That time will help me zero in on strong stocks. It only takes a few good trades to hit my target profit. Expect lots of movement and be flexible. The key to your trades is a good entry.

Support is at SPY $453 and $457. Resistance is at $464.

.

.

Daily Bulletin Continues...