Swing Traders – We Were Waiting For This Dip – Watch For This

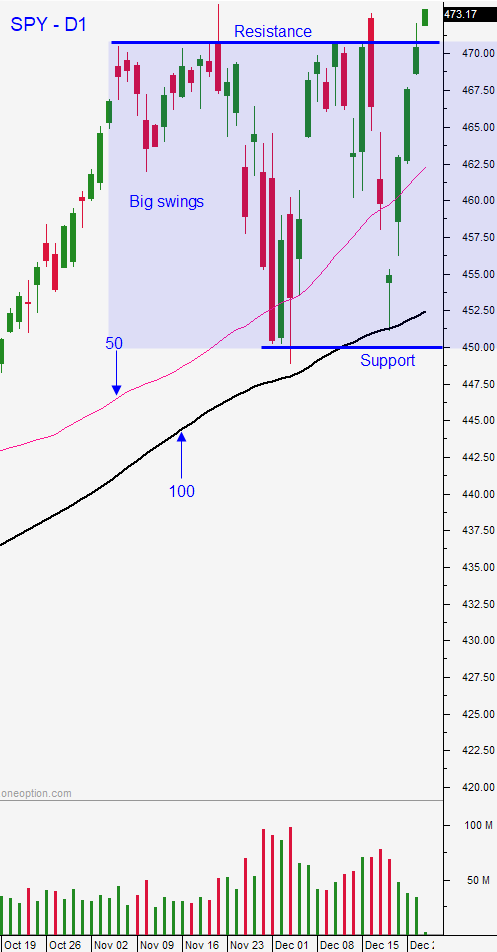

Posted 9:30 AM ET - – The warning signs were there and we were waiting for the market drop. The FOMC Minutes were a splash of cold water and the market pulled back off of its high. I believe that we will see follow through selling in the next few days. Be patient, this dip will be a buy. Buyers will support the SPY 100-day MA into earnings season. Wait for support and be ready to strike.

CLICK HERE TO WATCH THE VIDEO I RECORDED THIS MORNING WITH PICKS

Swing traders, we have been waiting patiently on the side lines. That light volume rally into year-end was vulnerable. An SPY drop to the 50-day MA would be a level to initiate new bullish put spreads. Don’t go crazy with them at that level. The market could be there very briefly (that is why we want to get a few trades off) or it could drop to the 100-day MA. If we get down to the 100-day you want to manage the bullish put spreads you have on and you want to wait for that support to be confirmed. When the market bounces off of the 100-day MA you can add aggressively to your bullish put spreads. I believe that buyers will remain engaged as earnings season approaches in a few weeks and that will keep longer term support levels intact.

Day traders should watch the open. In the video this morning I explained why we are likely to see follow through selling. That means that our most favorable scenario would be a meager bounce with tiny candles. Those tiny candles are a sign of resistance. During that bounce we can hunt for stocks with relative weakness. When the SPY bounce stalls, these will be your best candidates. I would make sure that you have D1 weakness as well with technical support breaches. We have to be very careful with shorts because we are trading against the long term market up trend. If we see stacked red candles consecutively on the open with little to no overlap, that would be a sign of trend strength to the downside. In a bull market, I would not be very active with this set up and I would be more inclined to wait for a bounce late in the day and trade that. If the market has long green candles stacked and we recover more than half of the drop since the FOMC minutes, it would be a sign that the market has a strong bid today and you can trade from the long side.

In the next day or two we will have follow though selling. I do not believe that we will see a decent, sustained rally until that low is set and tested. Be patient.

Support is at $475 and $477.30 and resistance is at the all-time high.

.

.

Daily Bulletin Continues...