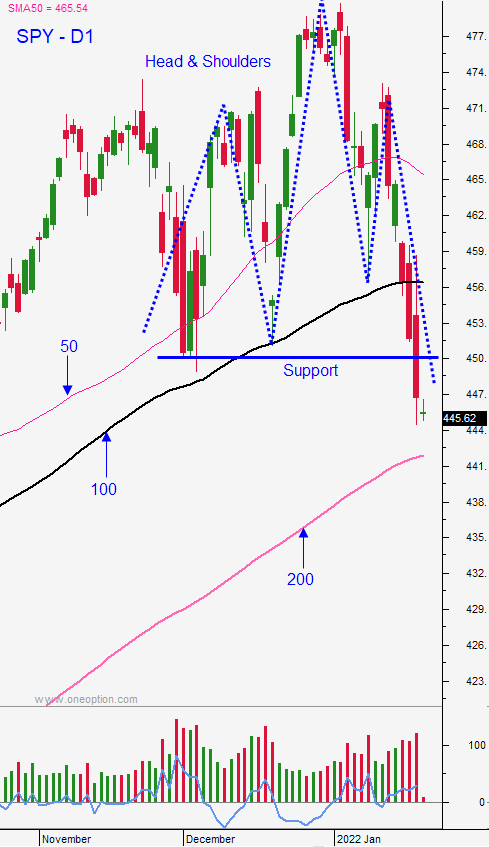

Market Has More Downside – Don’t Buy Until You See This

Posted 9:30 AM ET - The S&P 500 closed firmly below the 100-day MA yesterday on heavy selling pressure. Asset Managers are taking risk off before the FOMC statement next week. They are not going to buy until they see a capitulation low and here’s what it will look like.

Early in the day we will see a series of long red candles stacked on a 5 minute chart like we saw yesterday near the close. The selling will be relentless and it will feel like the market is never going to rally again. At the darkest hour, the longest red candle on a new low of the day will reverse at the last second and that candle will close near its open (high). That will result in a bullish hammer. The very next candle (not a candle 3 bars later, the very next one) needs to be a giant green candle. Then you need to see 4-5 more just like it. Very little overlap for each candle and no dojis. When you see this intraday pattern you will know that the short term low is in and that you can sell out of the money bullish put spreads.

When will we see this selling climax? It could be today or it could be next week before the FOMC statement. I believe that worst case scenarios are being price in and that some of this drop can be attributed to bullish speculators getting flushed out (dip buyers).

How should I trade it? I like selling out of the money bullish put spreads to take advantage of high option implied volatilities. This strategy also takes advantage of time premium decay.

Can I sell them on SPY/SPX? Yes, but I would make sure that you sell them below the low of the day when that reversal happens. That low is also likely to be below the 200-day MA so you will have that added support. You should wait for the SPY to rally above the 200-day if this all unfolds according to plan.

You know from my comments the last couple of months that conditions are changing. The warning signs have been there. You need to be prepared to trade both sides of the market.

Day traders, look for more downside today. Until you see the pattern mentioned above, favor the short side. If we see that selling climax and that bullish hammer and stacked green candles, buy SPY/ES. I would not buy SPY calls naked. IVs are too high. You can sell put credit spreads to finance call debit spreads. You do need to be short premium to take advantage of the IV crush when we bounce. You can also just buy stocks with relative strength.

Support is 200-day MA. Resistance is at 100-day MA

.

.

Daily Bulletin Continues...