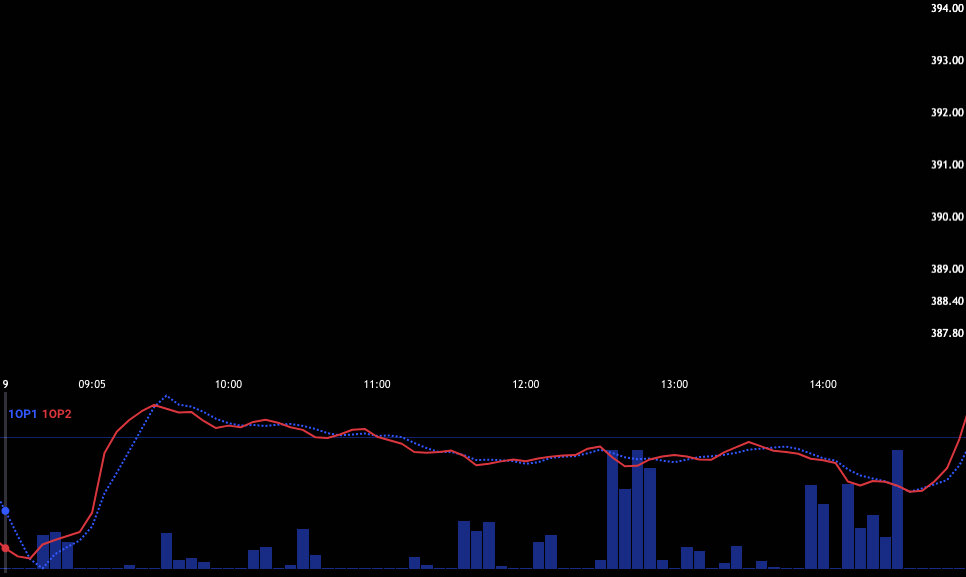

Daily Market Analysis

2023-01-09

Review our intraday commentary to learn how we interpret price action and build a market narrative.

Drag the blue slider to reveal the day's price action. Dots on the timeline represent comments and can be clicked. View the table below for all market-related comments and annotated charts (including those from after hours).

Abbreviated Comments View all

Click to expand content and reposition slider.

| 09:34:30 Pete |

PRE-OPEN MARKET COMMENTS MONDAY – The up trendline that connects the low from October 13th to the low from December 22nd held and the market rallied up to the 100-day MA last Friday. This morning we are going to open... |

|---|---|

| 09:34:36 Pete |

Good morning! |

| 09:42:13 Pete |

Try not to get overly excited about a breakout above the 100-day MA. We barely had to move to get here. That means the cross is less significant. |

| 09:50:18 Pete |

|

| 09:51:29 Pete |

Long ES 3945 full position |

Limited Access Only

Become a OneOption member to view all Daily Market Comments. Please visit our Start Here page to learn more about our system and how to become a member via our Free Trial.

Start Free Trial