Daily Market Analysis

2022-11-02

Review our intraday commentary to learn how we interpret price action and build a market narrative.

Drag the blue slider to reveal the day's price action. Dots on the timeline represent comments and can be clicked. View the table below for all market-related comments and annotated charts (including those from after hours).

Abbreviated Comments View all

Click to expand content and reposition slider.

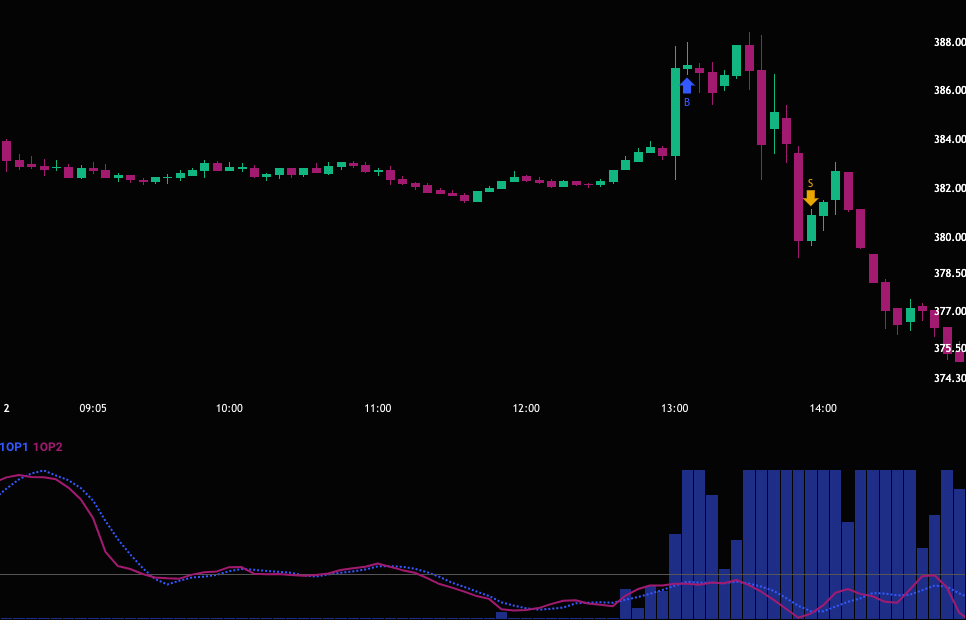

| 09:58:03 Pete |

Bearish 1OP cross, but very tiny bodied candles. We are also < prior day low. The stock will have to do all of the heavy lifting. |

|---|---|

| 14:00:18 Pete |

drum roll please |

| 14:02:27 Pete |

Long Short SPY $395/400 CDS for $1.65 and scratch |

| 14:03:15 Pete |

I expected better performance Mon and Tues and to be closer to the money prior to news so I am happy to scratch. |

| 14:07:21 Pete |

I should rephrase I am trying to scratch that CDS and I am offering it. |

Limited Access Only

Become a OneOption member to view all Daily Market Comments. Please visit our Start Here page to learn more about our system and how to become a member via our Free Trial.

Start Free Trial