OneOption offers a variety of research reports and on occasion, I like to serve up a freebie in my blog. I’m 3 for 3 over the last six months so let’s see if I can keep the string going with this trade. In order to be a successful trader, you must have an “edge”. Once it has been identified, you need to develop a systematic approach that helps you exploit that edge. I call mine OneWay.

My approach starts with the market. I recently posted extensive market commentary and you can use the link to get an overview. In general, the long term trend is up but we are long overdue for a 2%-3% pullback. I want to position myself on the long side of the market, but I want to give myself some “cushion” in case the recent dip turns out to be a bona-fide decline.

Once my market opinion has been formed, I use over 80 proprietary searches to filter 20k stocks down to 300 stocks. The 300 symbols are organized in a user friendly interface called the OneOption Scanner. Here I can click on the symbols and flip through the charts. I use my pattern recognition skills to identify candidates. I have found that my eyes can pick up on price patterns that a computer can’t. By the end of this process, I have narrowed the field down to approximately 20 stocks. To this point, all of the analysis has been technically driven. Now I lift up the hood and take a look at the fundamentals.

Three days ago a stock came up on my BDCCBreakout search. The search delivers stocks that have been in a long term uptrend and are making a 10-day high. When I conduct my fundamental research I look at the news (including the last earnings release), income statement, balance sheet, and financial ratios. Then I evaluate the overall macro environment for the company. The stock I found was LEH – Lehman Brothers Holdings, Inc. provides financial services to corporations, governments and municipalities, and institutional customers worldwide. These were my conclusions on LEH.

In December the company announced that fiscal fourth-quarter profit surged 22 percent on robust returns from stock and bond trading. EPS of $1.72 were up from last year’s $1.38 per share. Revenue jumped 23 percent to a record $4.5 billion from $3.7 billion in the year-ago period. “Once again, we have achieved outstanding results across all our business segments and geographic regions,” said CEO Richard Fuld. Lehman is best known as a fixed-income powerhouse, but Fuld has been attempting to expand its reputation beyond that by building up its investment banking unit to tap into record takeover and leveraged buyout activity. Investment banking showed a 5% rise in revenues last quarter. As interest rates rise so will bond activity as assets rotate from equities to fixed-income. LEH should have another banner year in 2007. February 1st, they raised the dividend by 25 percent and received authorization to buy back nearly 20 percent of its shares.

At this stage I like the stock but I need to quantify my opinion. Specifically, I need to determine the duration and magnitude of the trade and I need to assess my level of confidence. A chart will help me do that.

.

.

.

.

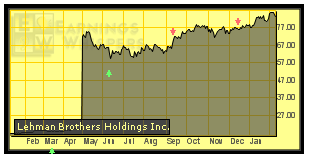

This is a very strong company and it trades at a low 1-year forward P/E of 10.6. I believe interest rates in 2007 will be stable and there is an outside chance they may move higher. If this scenario plays out, it will be very good for Lehman’s fixed income business. The share repurchase is massive and it will lend long-term support to the stock. I used a weekly chart to gain a longer term perspective and as you can see, there is minor support at $81 and major support at $79. Those two levels will give us a chance to reevaluate the trade if they are touched. This sector makes up 20% of the S&P 500 and it has been leading the market higher. The stocks are trading at very reasonable P/Es and the downside should be limited. The market is due for a pull-back so instead of buying calls, I will look for an opportunity to distance myself from the action. The financial stocks have pulled back due to concerns in non-prime lending. Although there may be a secondary impact, this is not a primary business segment for LEH. A put credit spread makes the most sense and the strategy is consistent with my opinion.

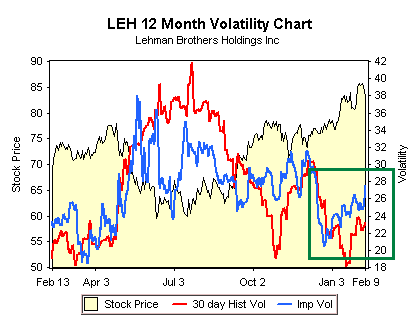

Before I look at the option prices, I want to get a feel for what the historical implied volatilities (IV) have been doing. In the chart below you can see in the green box that they have been on the rise. This plays right into our selling strategy and we will take advantage of the IV increase from 20 to 28. There are many option pricing models and I’m not going to concern myself with the strength and weaknesses of each. I’m also not overly concerned with volatility skews. I’m not looking for pricing inefficiencies. I will let the proprietary trading firms that have all of the mathematical models determine a “fair price”. My analysis focuses on the market and the stock. If I can nail down the direction, magnitude and duration, the optimal strategy will reveal itself. I include my confidence and the option IVs in the decision making process. I’m much more interested with the relative value of the historical IVs and I want to judge if they are “rich” or “lean” based on where they have been. From a trading standpoint, you do not need to take an advanced mathematics course to make sense of this all.

.

.

.

.

My strategy will be to sell a put credit spread on LEH. At the time of this blog, we are 3 days from expiration, so I can’t consider the front month (February) options. There is not enough premium to make it worth while. The March 80 – 75 puts spread is bid at $1.10 with the stock at $82.30. I will get to observe the stock at $81 support before I need to make a decision. If the stock blows through $81 and the market is weak, I should consider buying in the spread. If the market is weak, but the stock is resilient at $81, I might stick with the position.

Normally, as I get closer to expiration, I would loosen the stop and turn to the long term support level at $79. I do this because the position has the greatest risk when it is established. Once some of the time premium has come out of the options, the postion is easier to manage. At expiration, this is still above my break-even point of $78.90 ($80 short strike less the $1.10 credit = $78.90). The $81 stop is subjective but I must have a firm stop at $78.90, a level that would represent a bona-fide breakdown. At that stage, the original breakout above $79 has failed. In this case, the company announces earnings on March 15th (the day before expiration) and I need to handle my exit differently. As you can see from the chart (courtesy Earnings Whisper) the stock has had a positive reaction to the release the last three quarters. If I can buy the spread in for less than $.10 I will. If the stock is below $82 the eve of the number, I will buy-in the spread. There is no need to risk a bad number and my opinion is that the stock should have added to the breakout by that time.

.

.

.

.

There is one more caveat to the trade. If the SPY breaks support at 140 and the stock is maintaining support, I would exit the trade. Being in a stock with relative strength often gives me added protection. I can get the market direction wrong and contain my losses. If the market breaks-down, it is just a matter of time until the financials head lower. I’ll get out and wait for a future opportunity. The company itself wants to repurchase 20% of its shares at lower levels. I just want to wait for signs of support in the stock and the market.

If the trade works out (the stock stays above $80) and the options expire, it will yield a profit of $110 on a $390 investment. The margin requirement is the difference in the strike prices ($5.00) less the credit received ($1.10). The margin requirement also represents the maximum risk on the position (excluding commissions).