You might be thinking, “What a crazy option trading blog. This guy is a dozen articles into the series and he hasn’t even mentioned puts or calls.” Today we get one step closer. We have the stock targeted, we’ve watched for relative strength/weakness and now we have to form an opinion. I dissect my opinion into the following categories: direction, magnitude, duration.

To make money in this business, you have to be a directional trader! Run from the “guru” who will “teach” you how to make a fortune trading neutral strategies. Common sense should tell you that you can’t run a successful business without vision. You have to be able to look ahead, predict the future and plan accordingly. Every time you hit the trade button you should be willing to stand on top of your desk a scream your directional opinion out to the world. That level of confidence only comes from extensive research.

If you can’t nail down the direction – you don’t have a trade. If you like to trade GOOG but you can’t decide which way it will go, FIND ANOTHER STOCK! There are only about 20,000 others to choose from. When I’m considering direction, I also have to account for the fact that I could be wrong. I’d better have technical support (trend line, horizontal support, moving average) and sound fundamentals (no earnings releases, profitable). A stock with a volatile trading pattern is going to be less predictable and less desirable than a stock that is grinding higher.

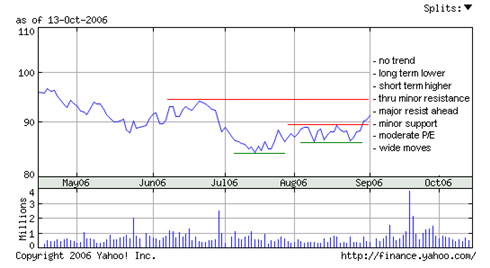

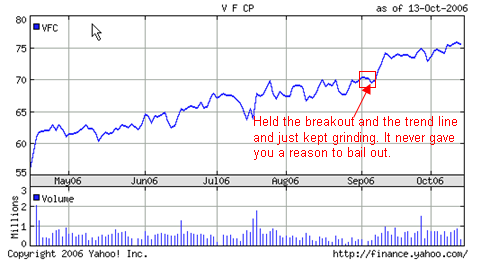

Let’s say that you are being forced to invest $5,000 of your hard earned money in one of the following two stocks. You can go long or short. Which one would you pick and why?

The first stock has been in a range. The longer term picture is pointing lower while the short term picture is improving. It has broken above minor resistance (red line) but it will soon be bumping up against major resistance. This stock could go either way and I would hate to dump any money into it.

The second stock has so much going for it. The chart pattern is tight, the stock is trending, it has broken through resistance, I have two strong support levels in case I’m wrong, it has consistent earnings and a relatively low P/E. I would be willing to put money into a long position and I might even get on top of my desk and shout my directional opinion out to the world. Why, because I have conducted extensive research and I have evidence to support my decision. If you are tempted to trade but you have not reached this juncture, keep looking for the right stock!

As you can see, this stock “behaved”. It held the breakout and never tested the trendline. It moved in a predictable manner and you would still be in the positon – it has not given you any reason to get out.

To be a good trader, you have to be able to predict the future. The next time you consider a trade, ask yourself if this stock is acting in an orderly manner. Write down why you think you’ll be right and identify your safety net in case you are wrong. Are you completely convinced? If you are, you’re ready to quantify the magnitude of the expected move.

My next option trading blog will help you do that. If you are curious about what happened to the first stock, take a guess and I will respond to your comment.

Last week I promised I would try to include a current pick. I couldn’t work it into this blog, so I’m going to post it in my reply this afternoon.