From my prior option trading blog you know that I have a proprietary scanner that searches for high probability trading set-ups. It took me years to develop and refine. During the programming process I learned that a fine balance exists and the searches can’t be too restrictive or too open. If they’re too restrictive, you get a handful of results and you miss the best trades. If they’re too open, you waste precious time.

I came up with the definitive solution. If my searches returned 300-400 symbols, I could quickly flip through the charts and use my pattern recognition skills to drill down. A trained eye is the most powerful trading tool you can own. It’s a skill that can be developed in a matter of months if you do it often.

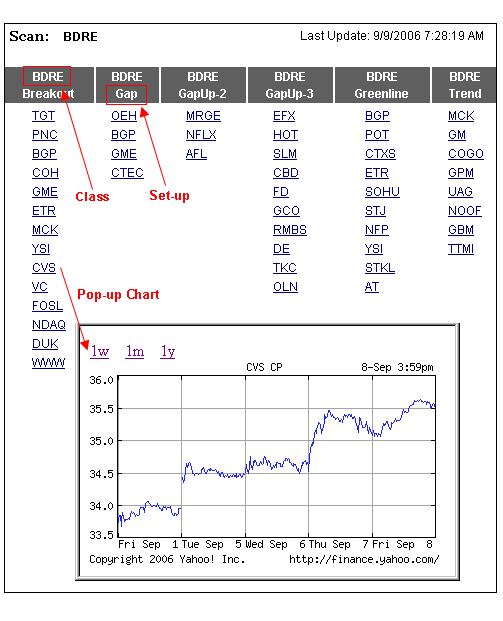

To make the process easier, I created a hierarchy for the 70+ searches. When I’m “flipping”, I know what each page and column represents and my eyes know what to look for. The searches are classified in the following way: bullish/bearish, day/week, reversal/continuation, early/confirmed. If you define each of these four selections, you have a “Class”. For instance, BDRE (bullish, day, reversal, early) stocks are all shown on the same page. Now that the Class is established, I arranged the columns according to specific “tail-end” patterns. I referred to them in the last post (breakouts/breakdowns, gaps, greenline/redline, trends). Sound complicated? It’s not. Here is a screen shot to help you visualize the interface.

From the screen shot above, you will see that the whole page contains the BDRE (bullish, day, reversal, early) Class. The first column contains symbols that conform to that pattern and are “breaking-out”. By clicking on the CVS symbol, a chart pops-up. I can position the chart anywhere in the window so that it doesn’t obstruct my view. By default, I want to start with the one week (1W) chart. If it looks good, I will view the one month (1M) chart. If not, I will move on to the next symbol. I call this routine – “flipping”.

This posting has turned into a description of my scanner. I don’t want to sound too promotional so I will confine the remarks to this article. Here are a few finishing points.

If you want to learn more about the search hierarchy and the patterns, read through more than 60 illustrated pages in my Tutorials section.

My next blog will focus on pattern recognition. I will include charts and I’ll show you what to look for. No matter how you get the symbols, the techniques will be of use. With the OneOption Scanner, it takes me about 40 minutes to “flip” each day and the process yields about 20 solid stocks (10 bullish, 10 bearish).