This option trading blog nearly concludes my series on “How I Trade Options”. After all of the research and analysis has been completed, I step back and I evaluate my level of confidence by breaking it into three categories; the market, the stock, recent performance. My option strategy will depend on where I am in the confidence spectrum. At the highest extreme I would be buying front month out of the money options. At the low end I would be selling out of the money naked put options on a stock I like fundamentally – in a scaled manner.

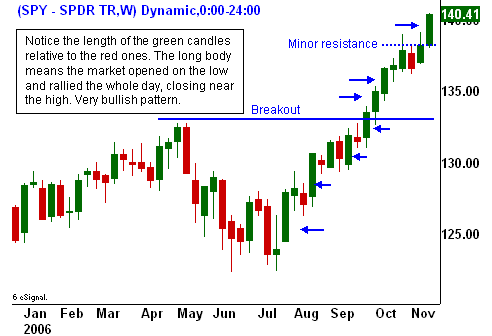

The Market – My confidence is always the highest when I can get a good read on the market. Since 75% of all stocks follow the market, this powerful force can help or hinder the trade. When the trade is going “with” the market I refer to it as having the “wind at my back”. If the market is in a strong predictable trend (like in the chart below), my confidence is elevated. I will buy front-month in-the-money (ITM) options because I want to “leverage up” at a time when I can get help from the market. I want an option position with a high delta that will move 1:1 with the stock. If there is a chance for an explosive market move within the trend (i.e. end-of-month strength or expiration related program trading), I might even buy front month out-of-the-money options. Personally, there is no greater display of confidence because EVERYTHING has to line up perfectly for this type of trade to work out. These high risk/reward trades are very rare. Most of the time, the market is in a choppy, indecisive mode and I can’t rely on it to any great degree. If the market is range-bound, it can be in a predictable trading pattern, but my confidence level is moderate at best. I have to be prepared for a move in either direction within the range and I’m ready to adjust if a breakout occurs. In this environment, my position won’t get assistance from the market and the stock will have to make the move on its own. Credit spreads and diagonal spreads are used in conjunction with premium buying strategies during these periods. There are times when the market is very unpredictable and it is transitioning. These inflection points can precede the next leg of a trend (continuation) or a reversal. Big, volatile swings make this a time to be very conservative and my approach consists of out-of-the-money (OTM) credit spreads since I want to distance myself from the action. I’m likely to scale into positions because I’m less certain about the direction. If the inflection point is at the low end of the market’s 52-week trading range, I will sell OTM naked put options on stocks that I really like fundamentally. This is the most conservative option strategy (within the context of speculation) I can use. I can distance my self from the action, take a stand on a stock at a level where I feel it represents a good value and capitalize on high implied volatilities.

The Stock – By now you should know that I don’t take a position unless I can get on top of my desk and scream out to the world why I like a particular stock. That said, there are still varying degrees of confidence. Personally, I feel the best about stocks that I like on a fundamental basis that have formed a big base below the mid-point of the 52-week range. At that level I’m getting a great stock at a great price and I know it has room to run. Technically, I like stocks that are in the middle of a move and I tend to be less aggressive at the extremes. In the middle, I have a number of support and resistance levels that can help me gauge the strength and the potential of the move. That’s not to say that I can’t feel good about a stock that is making a 52-week high. In those cases I have to use more caution because the stock is probably overbought and it can pullback at anytime. When I’m shorting a stock, I can also have a great deal of confidence. If the stock is all hype and it has yet to earn a penny, I have no problem shorting it. I just have to make sure that the signs of a “top” are in. The market moves higher with time and in general, I’m more confident in bullish positions than bearish ones. A stock’s historical price behavior will also impact my level of confidence and the strategy. There are stocks that trade in a very predictable grinding manner and others that whip around in a choppy fashion. In the former case, I might buy in-the-money call options if the stock is marching higher. In the later case, the stock is more volatile and the premiums will likely be higher. That sets me up for a put credit spread if the stock is trending higher in a choppy fashion.

My Performance – My psyche plays a huge role in the strategy selection process. If I’ve been trading poorly, I will almost always lean towards selling strategies. In doing so, I don’t have to sweat every tick. I also control my emotions by scaling into positions and by “down sizing” the number of contracts. During these times, I need to build positive momentum and sometimes my best trade is the one I don’t do. On the flip side, if I’m in a “zone”, I will stay aggressive. You have to strike while the iron is hot. I’ve learned to temper my confidence by taking money out of my account and by pretending that I just took a big hit. This is a reality check and it gets me back into a protective mind-set. Over-confidence is never good and my biggest losses have come after my biggest wins. Sound familiar?

In my next option trading blog I will conclude the series on “How I Trade Options”. I will expalin how the liquidity of the options (bid/ask spread, bid/ask size) and implied volatility of the options is factored into the decision process.