Wednesday’s Stock Option Trading Strategy!

I don't believe in this snap back rally and my option trading will focus on out-of-the-money call credit spreads.

Today, the market is reacting to statements made by Federal Reserve Vice Chairman Kohn. He suggested there might be a rate cut in December. From my perspective, another rate cut only puts us further behind the eight ball.

The Fed has already been very progressive in cutting rates and it seems as though economic conditions are deteriorating quickly. Fear is driving the market and the extent of the credit problem is not known. The dollar has been decimated and inflation is on the rise. Another rate cut will only add to this problem. It will also signal that the Fed is more concerned about economic conditions than it is about inflation.

The supply of homes on the market reached a 22-year high and building permits are at a 14-year low. Home prices posted their largest monthly decline since 1991. On average, prices fell 4.9% year-over-year according to the 20-city index.

Yesterday's rally was prompted by a $7.5 billion investment from the Abu Dhabi government as they took a stake in Citigroup. They needed the capital and this investment came at a high price since risk levels are elevated.

Today, the durable goods number was down .5% as expected. However, if you lift up the hood, it was terrible. Defense capital goods rose 16.1% and that was led by the demand for military ships. Excluding defense goods, orders dropped .9%. Demand for core capital investment goods fell 2.3%, the biggest decline since February. Orders for computers and other electronics (excluding semi conductors) dropped 8.4%, the biggest decline in a year.

A month ago, I felt as though the Fed might have catered to the financial community when it aggressively lowered rates. At the time the economic numbers continued to show strength. Now it appears that they lowered interest rates because they were concerned about economic stability. If they lower rates again, I fear that serious troubles lie ahead.

The Dow Jones Industrial Average has rallied 450 points in the last two days. Without question, some of this is attributable to short covering. I do not buy into this rally and I sense that the depth of the subprime problem will take many months to determine. When this rally runs out of steam it will present an opportunity to sell out of the money call credit spreads. That opportunity might come as early as this afternoon.

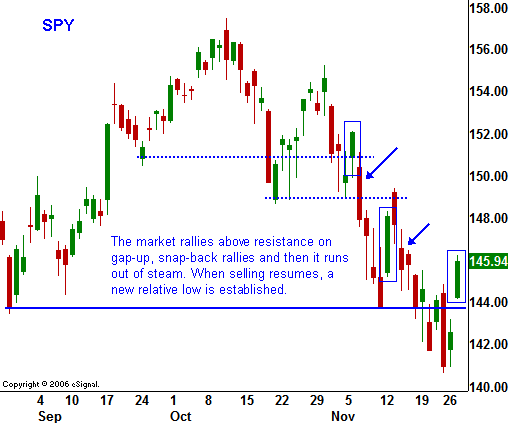

The market has corrected 10% and that provided a temporary support level from which to rally. End-of-month fund buying is also lending support to the market. If you look at the chart that I've drawn, you will see that recent gap-up rallies have quickly run their course. Once the bounce stalls, the selling resumes and a new relative low is established. This afternoon the Beige Book will be released. It will reveal economic strength/weakness across the country. It is somewhat of a sleeper event since it is released in the afternoon. Many traders forget to keep an eye on the market's reaction. Given the recent data, I believe it will show weakness.

After the initial surge this morning, the market has stalled. It has priced in a rate cut in December and it lacks any other catalyst to drive it higher. If the Beige Book shows substantial weakness, fear could topple this bounce. I will be shorting the market if the SPY breaks below 146 after 1:00 pm CT. That is a critical horizontal support level. By the same token, I will not stand in the way of this rally. If the market wants to continue higher this afternoon, I will wait patiently for another opportunity. The price action during this decline has been much heavier than the previous two declines this year. I do not believe that the market will be able to challenge the previous highs any time soon.

Remember, this is a time to take small positions. The market is not giving us any predictable price action and we don't want to piss away our trading capital.

Daily Bulletin Continues...