Stock Option Trading Strategy – Stay long commodities, beware of an air pocket.

Yesterday, the market pulled back a little after this week’s huge FOMC generated rally. Solid earnings from Oracle and Nike have negated Thursday’s pullback and now the market is almost where it closed Wednesday. Quadruple witching may have also contributed to the "pop" on today's open.

Next week there are many economic reports that will be released. Consumer confidence, durable goods, GDP, personal income, core PCE inflation and Chicago PMI are on deck. There are not any notable earnings releases so the move in one direction or the other will come from the economic data.

If the economic statistics are strong, the market will rally under the assumption that the Fed hit the panic button. If the numbers are weak, the reality of an economic slowdown may take root. Today, everything seems great. We had a couple of solid earnings reports and yesterday the Philly Fed and initial jobless claims came in better than expected.

I feel that you have to respect the upside breakout. I am sticking to commodity stocks. I also have a few Chinese stocks that I like. These will hold up well relative to the overall market.

When I see the dollar getting crushed, it worries me. That is an inflationary event and we don't have to look any further than oil to see it. Oil is dollar-denominated and as the dollar falls, the price of oil goes up. Most people don't realize how dramatically our purchasing power has declined. For anyone that has traveled overseas, you know what I'm talking about. Now, the Canadian dollar is at par with the US dollar.

If the market gets a bad economic number somewhere along the line, there is likely to be a big "air pocket" before prices stabilize. It will be fast and furious. Stay with strength and be ready to short companies that rely heavily on domestic consumers.

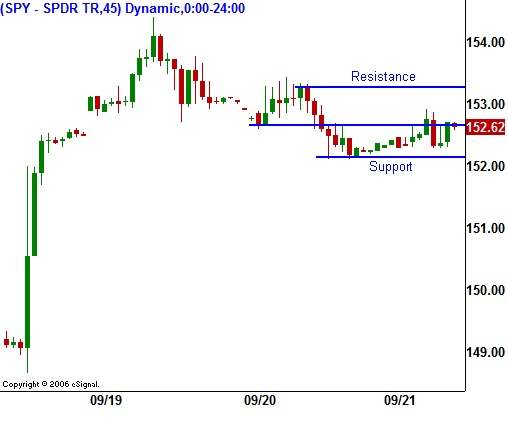

For today, I believe that most of the expiration firepower has been exhausted. I have provided the key support and resistance levels in the chart. I expect the market to stay within this range. If it does not, trade the breakout. I suspect that there is a better chance for the market to move higher than lower.

Daily Bulletin Continues...