Stock Option Trading Strategy – Long call options on energy and heavy equipment stocks.

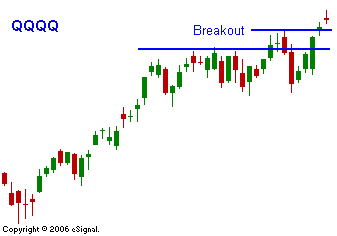

As expected the market liked the Unemployment Report. A .3% in rise in wage inflation did not raise concerns. A robust ISM number showed that manufacturing is on the rise. Seemingly, traders are growing accustomed to the Fed's “tight light” bias. In fact, the greater audience might be wondering how long the Fed will postpone a rate hike. Global interest rates are on the rise and that puts upward pressure on our interest rates. Solid growth and moderate inflation are a good combination for stocks. An interest rate increase due to economic growth is bullish and it would correct the current inverted yield curve. The market has stalled today after a nice opening "pop". The week ahead looks very quiet. The economic reports are relatively insignificant and there are only a few earnings releases. Furthermore, end of the month fund buying will have passed and option expiration is a week away. Look for very dull summer-like trading next week. I am long calls in energy stocks and heavy machinery stocks. I will remain bullish until I see a breakdown with follow through.

Daily Bulletin Continues...