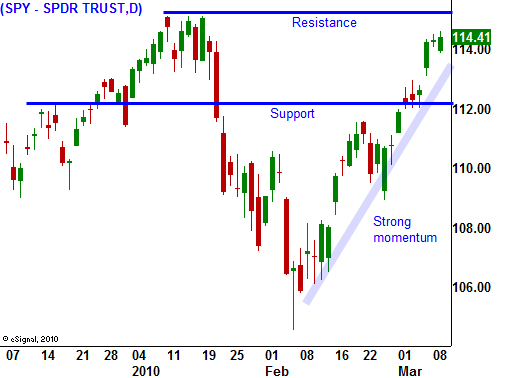

The Path of Least Resistance Is Higher – Look For Small Consistent Profits – Don’t Froce It!

The market continues to grind higher. The prevailing thought on "the street" is that the credit crisis is overblown. Traders are focusing on solid earnings, strong balance sheets and low interest rates. Economic conditions are not recovering at the pace everyone would like to see, but the consensus is that better times lie ahead.

The SPY is within striking distance of a new high for the year. Earnings season is almost over and the economic news is light. That means that the upward momentum will continue and it could be fueled by option expiration. If traders sense that the market will grind higher on an intraday basis, they will leg out of hedged positions and "goose" the market. That scenario is possible today.

The action is light and the market established its low for the day just after the open. Since then, it has been inching higher.

Initial jobless claims will be released on Thursday and retail sales will be released on Friday. Those are the two big events and neither should spoil this rally.

Europe, the United States and many other countries have painted themselves into the corner. Massive debt levels will limit growth opportunities. Social programs will have to be cut and taxes will have to be raised to balance the budget. Both will negatively impact discretionary spending. Over 70% of our economy is based on consumer spending.

Our government has been spending beyond its means for decades without any repercussions. People refused to believe that this will end abruptly. In the next five years, our government won't be able to meet basic obligations and credit markets will tighten up. That adjustment might be months away or it could be years away. When it happens, it will make last year looked like a cakewalk. Investors will realize that we can’t pay our bills and the risk premium in our bonds yields will jump.

I am selling put credit spreads on tech and energy. I want to generate income in distance myself from the action while this market grinds higher. I have also placed orders to buy puts on cyclical stocks when they break key support levels. They have strong momentum and they are priced for a full recovery. Do not buy puts on the stocks until they rollover. As they head higher, raise your trigger price.

Current conditions present a tough trading scenario. I feel the market will move higher and I feel the rug can get pulled out from under you at any moment. Consequently, I am keeping my trades small. This approach is similar to what I did in January and that worked out well. Try to be patient and settle for small consistent gains.

Daily Bulletin Continues...