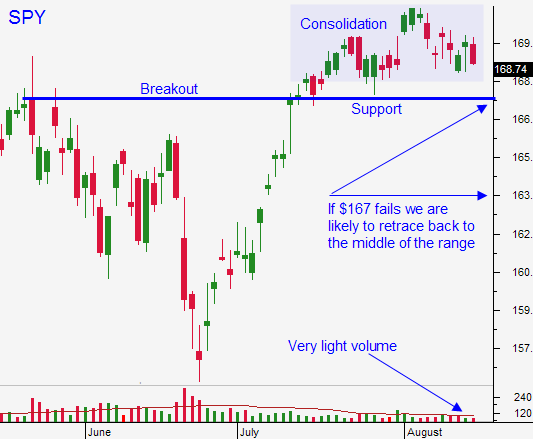

CSCO and WMT Spark Profit Taking. Retailers Will Weigh On the Market. Use SPY $167 As Your Guide

Today's comments were posted on the open. This week the market rally ran out of steam. There aren't any catalysts to attract buyers and Asset Managers won't chase stocks at an all-time high. Trading volumes are low and the news calendar is light.

Earnings season is winding down and profit growth year-over-year is low. These are some of the worst comps we've seen in years. However, cash flows are at record levels and corporations are using that money to buy back shares. During the next two weeks we will hear from retailers and the news could weigh on the market.

American Eagle and Aeropostale warned last week. Macy's and Wal-Mart both missed this week and consumers are postponing back to school purchases. Payroll tax hikes earlier this year and higher gasoline prices could be taking their toll.

Cisco missed estimates yesterday and that will weigh on the tech sector. Guidance was much more cautious than it was last quarter, but they see improving conditions in Europe.

GDP in the Eurozone ticked into positive territory for the first time in six quarters. Their official PMI's were better than expected in July and China said that exports to the EU increased 3%. These are all positive signs that activity might have bottomed out.

China's PMI was also better-than-expected in July and last week's economic releases also exceeded estimates (retail sales and trade balance). Government officials said that growth under 7% would not be tolerated and traders will take comfort knowing that the PBOC will provide a safety net if conditions deteriorate.

Domestic economic conditions are improving. ADP, GDP, ISM manufacturing, Chicago PMI and ISM services all exceeded estimates. The four-week moving average for initial jobless claims has fallen to its lowest level since November 2007. Today, initial claims fell by another 20,000. The Fed sees improving conditions and they will taper this fall.

Traders are growing accustomed to the Fed's monetary plans, but the solid initial claims number this morning sparked a 5 point drop in the S&P. Even if bond purchases are reduced, the FOMC's policy is still accommodative and liquidity is still being added to the banking system. The Fed has no intentions of tightening and eventually, traders will embrace tapering.

Politicians are in recess and debt ceiling threats will be minimal. Many analysts believe that Republicans will tie Obamacare costs to the debt ceiling. I don't believe the market will have a negative reaction to these negotiations since the can always gets kicked down the road at the last minute.

The next newsworthy release comes in one week when flash PMI's are released. As long as China and Europe are stable, the market should have a positive reaction. Once that news filters through, we are dead until Labor Day.

The macro backdrop is positive and I view this decline as mere profit taking. Stocks are heading into a very weak seasonal period and bullish speculators are getting shaken out of positions.

Asset Managers will not chase stocks at an all-time high. However, they will buy dips. That means that declines will be shallow and brief.

We have seen a little selling this week and earnings (CSCO and WMT) will weigh on the market. As long as the SPY can hold the breakout at $167, I will buy this dip. If that support fails I will shift to a bearish bias. Again, any decline will be shallow and brief so I need to be nimble when I buy puts.

Let this wave of selling run its course and look to buy stocks that have broken through horizontal resistance and have been able to hold that breakout. If the market bounces, these stocks will lead the rebound.

A negative tone has been set for the open this morning. Retail earnings will weigh on the market during the next week and Asset Managers could pull their bids. As bullish speculators bail out of positions, we could hit small air pocket.

Remember that the overall news is fairly good and that the volume is extremely light. Many traders are taking time off during this news vacuum. Nimble traders can find opportunities on the short side, but the better move will come on the rebound. Use the Live Update table in the Daily Report as your guide.

.

.

Daily Bulletin Continues...