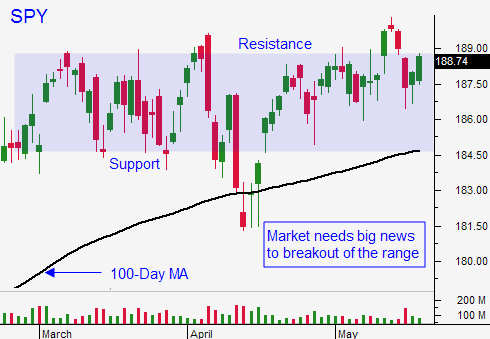

Market Will Stay In the Range – We Are Heading Into A News Vacuum

Posted 9:30 AM ET - There is not much to report. The market is stuck in a tight range and pre-holiday trading will keep it there.

The FOMC minutes tomorrow won't have much of an impact and the big release this week comes on Thursday. Flash PMI's will be reported and they could move the market. Growth will be stable, but sluggish. Don't expect a sustained reaction ahead of the holiday.

The jobs report is three weeks away and the next FOMC meeting is more than a month away. Earnings season is winding down and we are heading into a news vacuum.

Retailers are posting dismal results and that should weigh on the market. I am not seeing signs of pent-up demand.

Interest rates are at historic lows and equities will attract some money. However, at a forward P/E of 16, stocks are not cheap. If the market gets ahead of itself, Asset Managers will reduce risk.

These offsetting forces will keep us in the trading range.

We need to see signs of pent-up demand for the market to breakout. Conversely, we need to see a sharp decline in China's economic activity for breakdown. Without either of these two events, we will muddle around between SPY $183 and $189.

We are at the top of the range so I am more inclined to short at this level. I will day trade, but I will not take overnight positions. If we get a nice little pullback, I will sell some out of the money put credit spreads on strong stocks.

This is a time to keep your trading activity to a minimum. The rest of May should be very quiet.

.

.

Daily Bulletin Continues...