Look For Choppy Trading With A Negative Bias Into the FOMC Meeting Next Wed

Posted 9:25 AM ET - Yesterday we saw a light round of profit-taking. Investors are nervous ahead of the FOMC meeting next week and we could see additional selling into the release.

Traders will be watching for any change in the Fed's statement. In particular, they want to see if the phrase "considerable time" changes. If it does, it will signal that the Fed's tightening timetable has been moved forward.

I believe they will keep the language the same. The Fed will end its bond purchase program in October and that will be a big enough shock for the market to shoulder. They don't want the focus to immediately shift to tightening.

Bond Managers will watch economic releases very closely. They will sell bonds on strong data knowing that tightening is just around the corner. Interest rates will creep higher and I believe the Fed will change its language in November or December. At that stage, some of the interest rate adjustment will have already taken place and the news won't be a shocking.

Five-year trends die hard. That is true for equities and bonds. Once interest rates reverse, the move should be gradual. The ECB, Japan and China are accommodative and that will keep global rates from spiking.

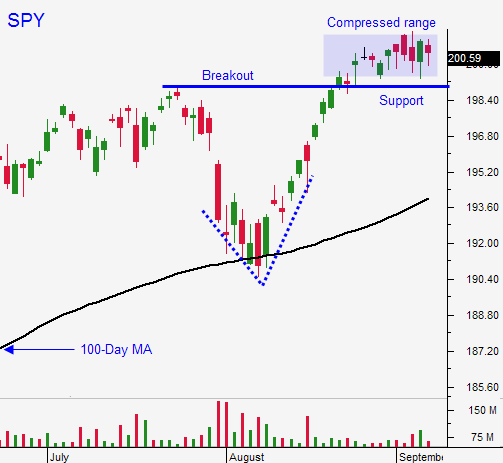

Yesterday I mentioned that the debt ceiling and health insurance premium hikes will weigh on the market during the next few weeks. September and October are seasonally weak and the SPY is likely to test the 100-Day MA.

Earnings are strong and domestic economic activity is robust. As long as interest rates gradually move higher, the market will be able to advance into year end.

China will post industrial production and retail sales tonight. Both numbers should be in line.

Look for choppy trading with a negative bias into the FOMC statement next week. I will be day trading from the short side and I will buy a few puts if the SPY closes below $199.

If you are long calls, use SPY $199 as your

.

.

Daily Bulletin Continues...