Use This Tactic and the Free Trial To Find Trades – SPY Will Stay Above $206 Next Week

I am offering a FREE TRIAL and you can see every new trade signal for every stock. Use the tactic I describe below to find trades. CLICK HERE TO REGISTER

Posted 9:40 AM ET - The market continues to inch higher on light volume. Earnings season is providing a bid to the market even though there have been a fair number of warnings. The S&P 500 is close to the upper end of the range and future gains will be hard-fought.

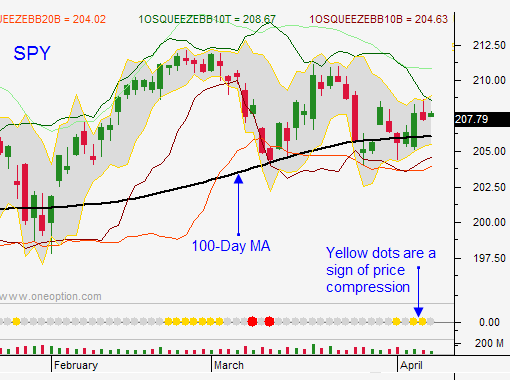

J.P. Morgan and Wells Fargo will post before the open on Tuesday. Intel will post after the close on Tuesday and the releases will gradually increase. I believe the market will stay above the 100-day moving average (SPY $206) through April option expiration next Friday.

I sold out of the money April put credit spreads earlier in the week and time decay is already working its magic. Most of the stocks have moved higher and I should be able to buy the spreads back for a nice profit next week.

The market has been choppy, but I have been able to find pockets of strength. This week I used my trading system to find opportunities in Chinese Internet stocks and in the tech and energy sectors. Use your current trading tools to identify stocks that are trading near a three-month low and have formed a base. Take the free trial and check those symbols for buy signals. My trading system has been producing incredible results and these are good candidates.

China will post economic numbers Monday and Tuesday. They will be soft, but the PBOC will ease if needed. That will keep a bid to their market.

Domestic economic conditions are slipping and Q1 GDP could come in below 1%. This will keep the Fed from tightening in June.

Greece could get booted out of the EU this summer. That could be positive from a longer-term perspective as we remove this thorn from our sides. On a short-term basis, investors could get spooked. This credit crisis has been broadcasted for the last two years so it won't blindside anyone. I believe any related decline will be short-lived.

We are trapped in a range within a range and I don't see that changing next week. Earnings season will really crank up in two weeks and that is when we could get a nice directional move.

Look for pockets of strength and try to sell some out of the money put credit spreads in April.

.

.

Daily Bulletin Continues...