The 200-Day MA Will Hold While We Wait For Greece – Binary Event

LEARN HOW TO GET THE PLATFORM FREE and get my market comments before the open.

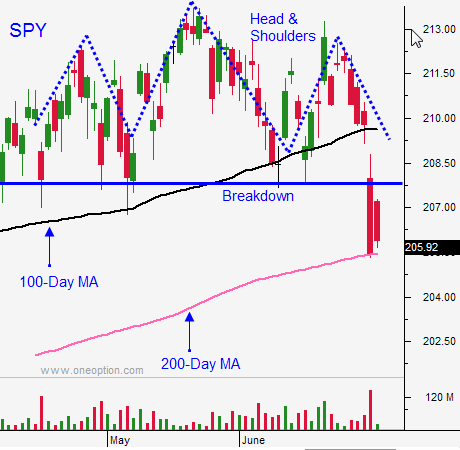

Posted 11:50 AM ET - Yesterday I wanted to make two key points: the market would test the 200-day moving average and you should not take any overnight short positions. I hope you made money day trading from the short side and I hope you closed out your positions.

The EU made a last-ditch attempt at a deal and they submitted a proposal to Greece. The fact that they are still talking is positive.

The price action is very choppy today and this is a binary event. Trading volumes are low ahead of the holiday and everyone is waiting for the outcome. This feels like a pre-FOMC environment where everyone is waiting for the news.

The economic news this week will take a backseat to what happens in Greece. ISM manufacturing, ADP and official PMI's will be posted tomorrow. Thursday's jobs report is expected to come in at 223,000 and anything close (+ or – 30K) will not spark much of a reaction.

Greece will try to find middle ground and a six-month deal is likely (80%). The market will stage a relief rally, but we won't make new highs. The Greek saga will continue and the focus will shift to a potential Fed rate hike in September. This will keep a lid on the rally and we will see sector rotation during earnings season. I will sell out of the money bullish put spreads on a Greek deal and I will continue to trade stocks that are breaking out if this scenario unfolds.

In the unlikely event of Grexit (20%), I will patiently wait for the market to find support. Asset Managers will pull bids and investors/bullish speculators who were caught off-guard will hit the panic button. The long-awaited correction will occur and we could see SPY $190. At SPY $197.50, I will become an anxious buyer, but I will wait for support. Once I see a deep intraday low and a sharp reversal, I will know that we are poised to capitulate. I will aggressively sell bullish put spreads and I will use the proceeds to buy calls. This would be one of the best trading opportunities of the year. I believe that traders will rejoice that Greece is finally out of the way and the EU will send a clear message to other members. Credit risks are contained and this rally would slingshot us to a new all-time high.

While we wait for the news, the market will chop around. The 200-day moving average will hold until there is an outcome.

I am day trading and my size is small.

If Grexit happens, the move will be very swift. Short positions should only be taken by day traders who understand that the vicious snapback rally could come at any time. I will keep my focus and I will search for bullish trades. This swift decline is unlikely, but I want to be ready in the event that it happens. This is been a challenging environment and I don't want to miss one of the best traits of the year.

The most likely outcome is a six-month deal. The market will bounce and we will be back into a tight trading range.

Wait for this event to play out.

.

.

Daily Bulletin Continues...