The Market Needs To Set An Early Low and Grind Back – Try To Stick With Long Positions

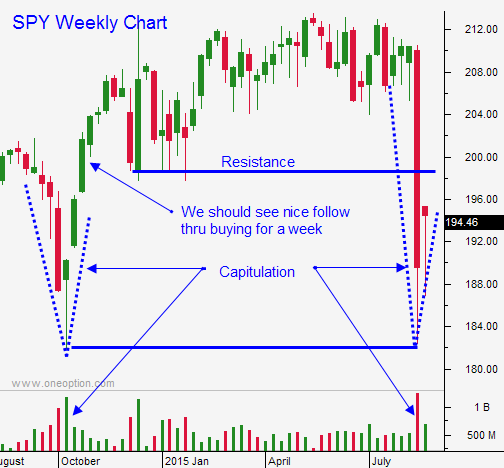

Posted 9:00 AM ET - Last Monday, the market fell to levels not seen since October 2014. It instantly bounced and we have not been able to challenge that low. I believe SPY $182 is the lowest level we will see this year – even if the Fed hikes in September.

The market is down 15% from its high and we have the correction everyone has been waiting for. US economic conditions are stable, but growth is sluggish.

Actions by the PBOC and by China’s government will stabilize Asian markets into year end. I don’t believe the Fed will hike rates and this will move their time table back to March 2016. This will spark a rally in the US.

Interest rates are near historic lows and equities remain the best game in town. Remember, that the shares outstanding have fallen by 50% in the last 10 years due to buy backs (buybacks are still at record levels). There is more money chasing fewer shares. This is a powerful force and year end strength will keep buyers engaged.

Without question, the longer term macro picture is deteriorating. China is slowing down after decades of hyper growth and there is excess. Their housing market and subsidized industries will struggle and I will be watching for defaults in their shadow banking industry. In time they will increase and credit concerns will escalate. When they do, we will see a very nasty and prolonged market decline.

I am frequently asked, “Pete when will this credit crisis happen?” It will happen when we see a rise in defaults. That could have happened a year ago, it could happen next month or it could happen in 3 years. It is pointless to try and guess. Anyone shorting this market has been carried out in a body bag.

I do not see credit spreads widening and US bonds did not spike last week. There is no flight to safety and I believe this is a buying opportunity. There is plenty of room for a nice rally, but I also believe that the market is topping and we will not challenge the all-time high.

I am long SPY calls and they were profitable as of the close Friday. I am going to try and stick with the position as long as possible and I expected a rally this week.

Major economic releases are scheduled. ISM manufacturing will be soft, ISM services will be strong and the jobs numbers will be in line (225K). Some will argue that the numbers are good enough for the Fed to hike rates and others will argue that the numbers are stable but not strong enough for the Fed to hike. The reaction will be mixed.

China has done all it can to stop the hemorrhage and their market should find a bid. Their growth is slowing steadily, but it is not falling off a cliff.

After this week, FOMC nervousness will surface. We will not have a meaningful rally until the FOMC on September 17th.

I am looking for positive price action this week. The early decline this morning should find support and we should be able to recover. This type of price action would indicate that buyers are still engaged. I will stick with my calls if I see this.

If the market makes a new low after the first two hours of trading, we will probably drift lower and I will be forced out of my calls. There is support at SPY $195. That was the close Wednesday and it was the low Thursday.

Look for an early low and a grind back during the day. If the market makes a new low for the day after 2 hours of trading, exit long positions.

.

.

Daily Bulletin Continues...