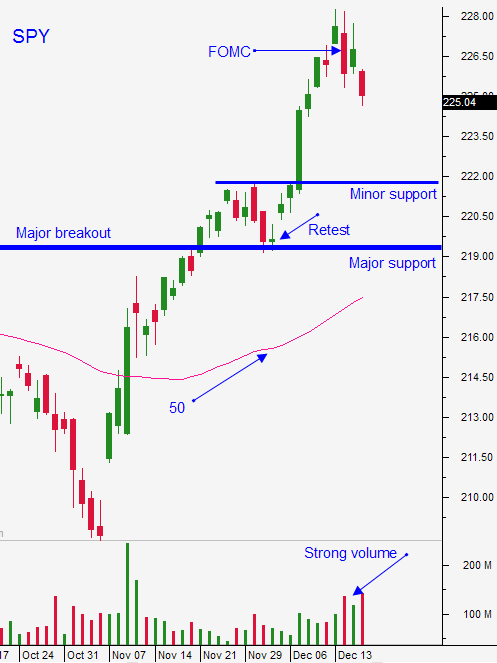

Market Will Float Higher – Wait For Support and Buy This Dip

Posted 9:00 AM ET - Last week the market rallied to a new all-time high and it retreated slightly after a hawkish FOMC statement. All things considered stocks shouldered the news well and seasonal strength will float us higher once support is established.

The Fed expects to raise rates three times next year (up from two times). This almost guarantees a rate hike in the first half of 2017.

Higher interest rates will weigh on the market if economic growth stalls. As long as we continue to see global growth - stocks will move higher. Lower corporate taxes and reduced business regulation is good for profits and that has buyers excited.

Year-end strength is an anomaly I’ve grown to respect. Asset Managers get paid based on performance. The higher we go, the more they make. Investors also feel more optimistic when they open their year-end statements. A small bid can push stocks higher when the volume is light.

GDP and durable goods orders won't have much of a market impact this week.

There are a handful of earnings reports and they will provide some trading opportunities.

Tech is catching a bid and this sector has lagged. This is where I'm looking for buying opportunities.

Trim your size and activity this week. Trading volumes will steadily decline ahead of Christmas. You can be a little more aggressive when the market opens lower and you should be more passive when the market opens higher.

I will not trade during the first 30 minutes today. Stocks that are moving higher need to prove that the bid is strong and that the move is sustainable.

Support is at SPY $222 and resistance is at the all-time high.

Trade from the long side.

.

.

Daily Bulletin Continues...